In the contemporary era, investors want a portfolio with a purpose. They now plan to invest with integrity and support businesses that make the world a better place.

The MagnifyMoney research shows that 67% of individual investors think they have a responsibility to put money towards companies that have a positive impact around the world.

Some of the key findings of the MagnifyMoney survey are:

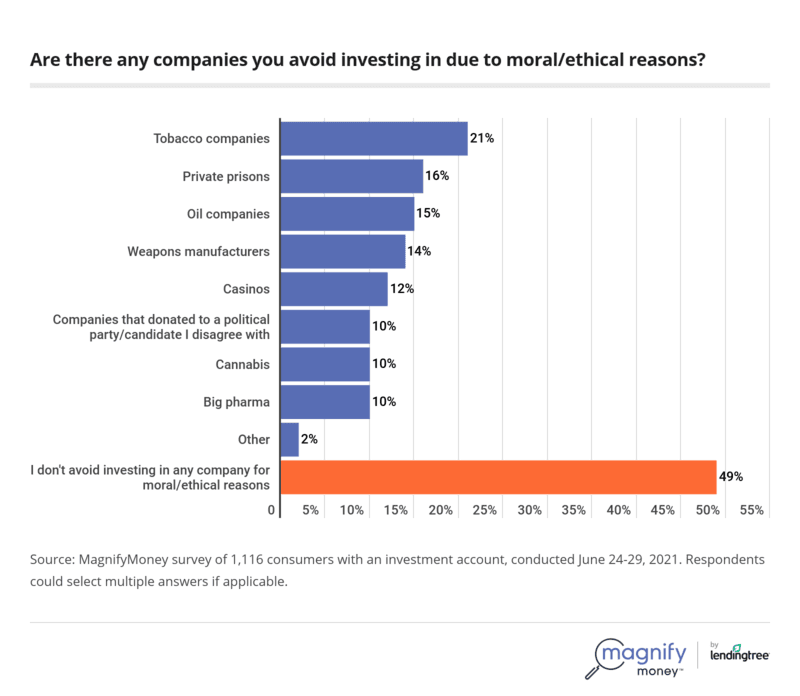

1. Investors want their moral and ethical values to show in their portfolios. The survey highlights more than half (51%) of investors avoid investing in at least one company (tobacco, private prisons and oil top the list). Two-thirds (67%) of individual investors think that they have a responsibility to put their money in businesses that will make the world a better place.

The investors avoid investing in:

- Tobacco Companies

- Private prisons

- Oil companies

- Weapons manufacturers

2. Gen Zers are most selective to avoid companies they deem unethical, according to the report. It mentions that nearly three-quarters (73%) of Gen Z (ages 18 to 24) investors have avoided sinking money into companies for ethical reasons, compared with 56% of millennials, 48% of Gen Xers, and 39% of baby boomers.

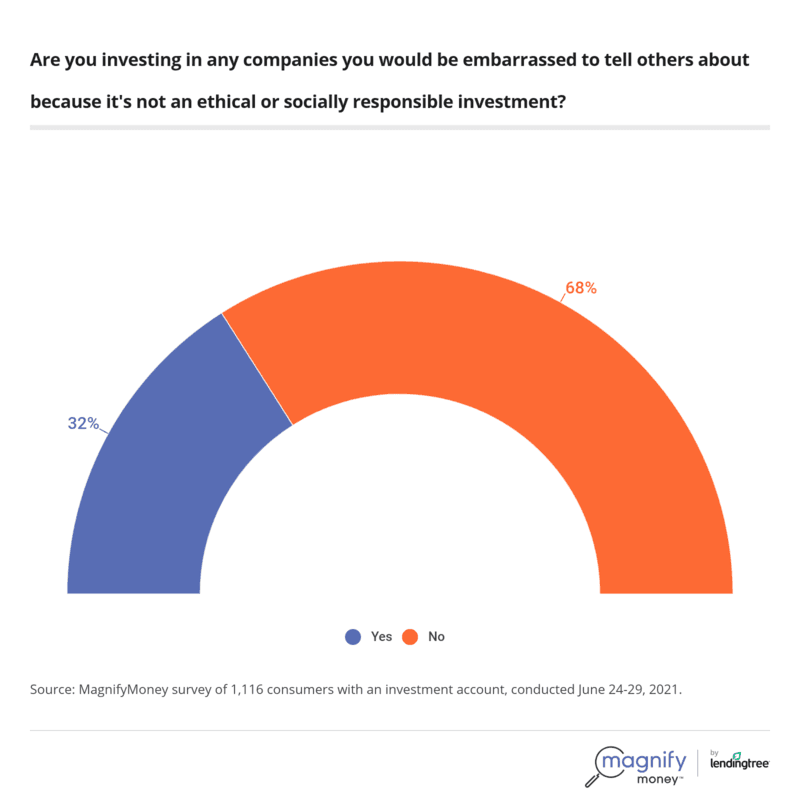

3. The report clearly highlights that as much as investors want to ignore the lure of a lucrative (but not socially responsible) investment, money is still a driver, leading to some cognitive dissonance. For example, 32% of investors say that they feel guilty investing in certain stocks but they do so anyway, and the same percentage say they currently invest in a company they’d be embarrassed for others to know about.

4. Consumers say morals and ethics play a big role in their investing decisions, but most find dollar signs hard to ignore. Although 65% of investors say they’re willing to sacrifice a higher return for a better impact, 67% would opt to invest in an oil company that offered double the return of a solar energy company.

5. The report also mentions that It’s hard to define what it truly means to be socially responsible, and investors want financial professionals to help. 70% think financial advisors or similar experts should warn consumers when investing in a company that doesn’t align with their values.

What is Socially Responsible Investing?

Socially responsible investing is becoming very popular nowadays. SRI is an investing strategy that aims to generate both financial returns for an investor as well as social change. It involves investing in companies that are involved in things like environmental sustainability, alternative energy, or clean technology and eschewing those that conflict with the personal values. SRI can also be known as values-based investing, sustainable investing, and ethical investing.

Because of increasing global warming and climate change, socially responsible investing has trended. Socially responsible Investments avoid harmful industries such as coal mining due to the negative environmental impact of their business practices.

Types of Socially Responsible Investments

There are three different types of Socially Responsible Investments namely:

1. Mutual Funds and Exchange Traded Funds

An investor can invest in either of the two funds as Several mutual funds and ETFs adhere to the ESG (Environmental, Social, and Governance) criteria.

2. Community Investments

An investor can also put their money directly into projects that benefit communities thereby contributing to community development financial institutions (CDFIs).

3. Microfinance

Another way is microfinance or small loans to startups in which individuals can make socially sound investments.

A Brief History

SRI approach may have started in the 1700s with Quakers, a group of individuals who were part of the Religious Society of Friends. The group refused to participate in the slave trade i.e. the business of buying and selling human beings.

Another significant promoter of the SRI approach was John Wesley, the founder of the Methodist movement. Wesley urged his followers to stop profiting at the expense of their neighbors. John also asked his group to avoid any kind of participation in gambling and supporting industries, which used toxic materials or earned money through alcohol, tobacco, weapons, or gambling. These actions essentially led to the evolution of social investment screens.

Although socially responsible investing started as a simple practice in religious communities and societies, it has evolved to become a mainstream activity now. In fact, considering the damage already done to the environment, SRI is gaining a lot of popularity.

SRI approach is the need of the hour. With an aim to achieve financial gain and environmental goals, SRI can surely help in making a positive change in society.