Big governmental organizations and other economic forums are always talking about, global wealth and its management, but what is Global wealth and how does it affect you?

Global wealth refers to all the assets and money that exist in all the areas of the world considered and analyzed together. It is very significant to be informed about Global wealth through comprehensive reports as through these we get to know about how the world’s net wealth is distributed and managed. Not only this, but Global wealth analysis also helps to keep a track of both the growth and distribution of wealth – in terms of the numbers of millionaires and billionaires and the proportion of wealth that they hold – as well as the current status of inequality around the world. Below are some key highlights and important findings of the Global Wealth Report by Credit Suisse Research Institute that published its twelfth Global Wealth Report showing continued wealth growth:

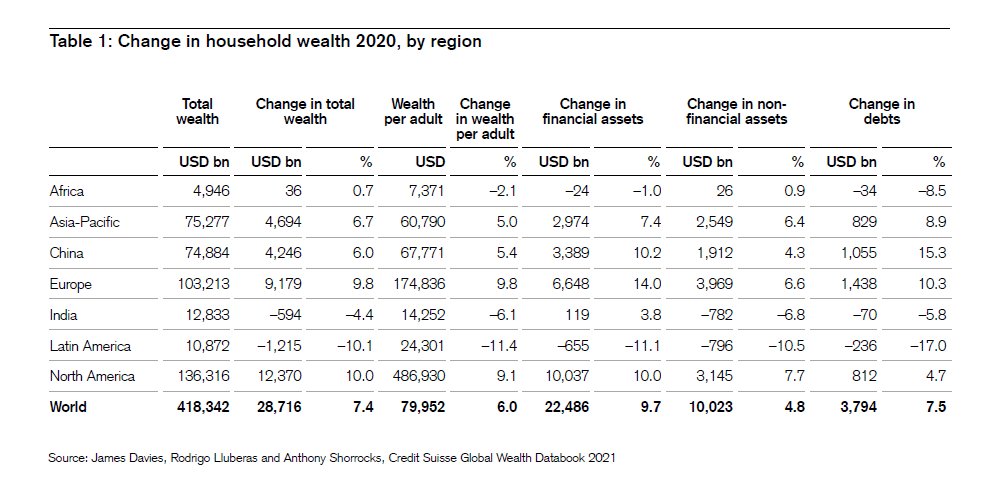

- Wealth creation in 2020 was largely immune to the challenges facing the world due to the actions taken by governments and central banks to mitigate the economic impact of Covid-19. Total global wealth grew by 7.4% and wealth per adult rose by 6% to reach another record high of USD 79,952.

- The pandemic had a profound short-term impact on global markets in the first quarter of 2020 which was largely reversed by the end of June. Surprisingly, in the second half of 2020 share prices continued on an upward path, reaching record levels by the end of the year. Housing markets also benefitted from the prevailing optimism.

- The regional breakdown shows that total wealth rose by USD 12.4 trillion in North America and by USD 9.2 trillion in Europe. These two regions accounted for the bulk of the wealth gains in 2020, with China adding another USD 4.2 trillion and the Asia-Pacific region (excluding China and India) another USD 4.7 trillion.

- India and Latin America both recorded losses in 2020. Total wealth fell in India by USD 594 billion, or 4.4% in percentage terms. Latin America appears to have been the worst-performing region, with total wealth dropping by 11.4% or USD 1.2 trillion.

- Wealth impacts of the pandemic have differed among population subgroups due to two main factors: portfolio composition and income shocks. The wealth of those with a higher share of equities among their assets, e.g. late middle age individuals, men, and wealthier groups in general, tended to fare better. Homeowners in most markets have seen capital gains due to rising house prices.

- There have been large differences in income shocks during the pandemic. In many high-income countries, the loss of labor or business income was softened by emergency benefits and employment policies. Labor force participation declined over the course of 2020 for both men and women, but the size of the decline was similar, at least in most advanced economies.

- Wealth differences between adults widened in 2020. The global number of millionaires expanded by 5.2 million to reach 56.1 million. As a result, an adult now needs more than USD 1 million to belong to the global top 1%. A year ago, the requirement for a top 1% membership was USD 988,103. So, 2020 marks the year when for the first time, more than one percent of all global adults are in nominal terms dollar millionaires.

- Talking about wealth outlook 2020-25, Global wealth is projected to rise by 39% over the next five years, reaching USD 583 trillion by 2025. Low and middle-income countries are responsible for 42% of the growth, although they account for just 33% of current wealth. Wealth per adult is projected to increase by 31%, passing the mark of USD 100,000.

- According to Anthony Shorrocks, economist and report author, “As we noted last year, global wealth not only held steady in the face of such turmoil but in fact rapidly increased in the second half of the year. Indeed wealth creation in 2020 appears to have been completely detached from the economic woes resulting from COVID-19. If asset price increases are set aside, then global household wealth may well have fallen. In the lower wealth bands where financial assets are less prevalent, wealth has tended to stand still, or, in many cases, regressed. Some of the underlying factors may self-correct over time. For example, interest rates will begin to rise again at some point, and this will dampen asset prices.”

- Nannette Hechler-Fayd’herbe, Chief Investment Officer International Wealth Management and Global Head of Economics & Research at Credit Suisse said: “There is no denying actions taken by governments and central banks to organize massive income transfer programs to support the individuals and businesses most adversely affected by the pandemic, and by lowering interest rates, have successfully averted a full-scale global crisis.

- Indeed wealth creation in 2020 appears to have been completely detached from the economic woes resulting from Covid-19. If asset price increases are set aside, then global household wealth may well have fallen. In the lower wealth bands where financial assets are less prevalent, wealth has tended to stand still, or, in many cases, regressed. Some of the underlying factors may self-correct over time. For example, interest rates will begin to rise again at some point, and this will dampen asset prices.

- Although successful, these interventions have come at a great cost. Public debt relative to GDP has risen throughout the world by 20 percentage points or more in many countries. Generous payments from the public sector to households have meant that disposable household income has been relatively stable and has even risen in some countries. Coupled with restricted consumption, household saving has surged inflating household financial assets and lowering debts. The lowering of interest rates by central banks has probably had the greatest impact. It is a major reason why share prices and house prices have flourished, and these translate directly into our valuations of household wealth.

- Female workers initially suffered disproportionately from the pandemic, partly because of their high representation in businesses and industries badly affected by the pandemic, such as restaurants, hotels, personal service, and retail.

- Depreciation of the US dollar flatters these gains. If exchange rates had remained the same as in 2019, total wealth would have grown by 4.1% and wealth per adult by 2.7%. The world’s 500 richest added $1.8 trillion to net worth in 2020. The reasons for rising in wealth are: the action of governments and central banks such as interest rate reduction, continued rise in share prices on an upward path, reaching record levels by the end of the year.

- The Gini coefficient increased from 74.7 in 2000 to 82.0 in 2019 and reached 82.3 at the end of 2020 in India. The wealth share of the top 1% went up from 33.5% in 2000 to 39.5% in 2019 and rose further to 40.5% by the end of 2020. India is the second most unequal country behind Brazil whose top 1% holds 49.6% of the nation’s wealth. The wealth share of the top 1% in the US is 35.3%, China 30.6 %, UK 23.1%, Italy 22.2%. It means despite a decline in wealth creation, rich Indians have garnered more proportion of wealth than in previous years.

To conclude

The worldwide spread Coronavirus pandemic has proved to be a boon for the rich and bane for the poor. Be it is Credit Suisse’s 12th Global Wealth Report or Hurun Global Rich List or Forbes’ 35th annual list of the world’s billionaires, all of them have analyzed the rising inequality during the pandemic. In a time when people are losing lives and livelihoods due to the crisis inflicted by the pandemic, the wealth of billionaires and the number of billionaires has increased, and hence, inequality is accelerating between and within countries. It is the need of the hour to address the growing inequality before it annihilates social stability and cohesion.

SOURCE: The statistics and information in the article have been noted from the Credit Suisse Research Institute’s global wealth report 2021.