Discover

-

How can you start investing in Mutual Funds?

-

Is Gold a safe investment plan?

-

What is the best investment for retirement planning?

-

Do investors get any tax benefits under mutual funds?

With the 2024 Lok Sabha elections, the benchmark stock market indices, S&P BSE Sensex and NSE Nifty 50 have tumbled due to high volatility. This unexpectedness has sent waves through the market and investment plans of people. It has dampened the previously optimistic mood about the stock market, driven by the exit poll projections of a decisive victory for the BJP. PSU stocks led the biggest decline in today’s session, in the Energy sector, Adani Green Energy, Adani Ports and Adani Enterprise are the biggest losers.

Furthermore, amidst the broader market downturn, Reliance Industries Limited (RIL) shareholders suffered a massive loss as the stock tanked by 9.6% on the Bombay Stock Exchange, leading to an erosion of Rs 1.67lakh crore.

Also Read: Surviving A Stock Market Crash

Stock Market stability is a very unpredictable thing, you earn money one day or lose them the next day. But what if there are investment options that are safe and will give returns slightly better than stock markets?

Do you want to know more about them?

Let’s explore some of the safer options for investment.

What are some of the safest investment options?

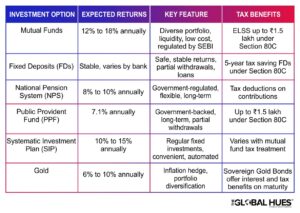

Below is an explanation of some of the safest investment options in 2024:

Fixed Deposit (FDs)

Fixed Deposit is an investment option that has been popular since our grandparents’ and parents’ time because they provide stable returns with minimal risks. It is one of the safest investment options because our money is locked in for a pre-specified term at interest rates varying over the amount and deposit tenure.

Five-year tax saving deposits offer tax deductions up to Rs 1.5 lakh a year under section 80C of the Income Tax Act 1961. Other facilities like partial withdrawal and loans against the deposit are also available. Anyone with a bank account can open an FD for as low as INR 1,000 and the minimum tenure is for 7 days.

How to calculate FD interests?

Two methods are used to calculate interest on a Fixed Deposit. One is Simple Interest and another is Compound Interest. Banks may use both depending on the tenure and deposit amount. Moreover, with simple interest, interest is earned only on the principal amount. With compound interest, the interest is earned on the principal as well as the interest.

Read More: Liquid Fund Vs. FD: How To Compare The Risks And Rewards

National Pension System (NPS)

The National Pension System is a government-based investment and voluntary retirement savings scheme. It is regulated by the Pension Fund Regulatory and Development Authority (PFRDA). The NPS fund is invested in equities, corporate bonds, and government securities through various investment options. The NPS scheme matures only when the people reach 60. The expected interest rate of NPS investment is 8% to 10% annually.

Why choose NPS?

NPS’s major advantage is tax savings. You can deduct your contributions from your taxable income, potentially lowering your tax bill. NPS is also flexible, allowing you to choose your investment options and adjust your contribution amount as needed.

Public Provident Fund (PPF)

PPF is a government savings plan that allows you to invest between ₹500 and ₹1.5 lakh annually and get tax benefits (Section 80C). It offers guaranteed returns (currently 7.1%) and is safe due to government backing. There’s a 15-year lock-in period, but you can make partial withdrawals after 7 years. It’s a great long-term option: you can get your money at maturity or extend it in 5-year blocks.

How to invest in PPF?

PPF accounts can be opened at almost any bank in India or your local post office. There’s a minimum deposit of ₹500 but you can invest up to ₹1.5 lakh each year. The investment can be done in one lump sum or spread out over multiple deposits throughout the year. You need to fill out an application form and provide your KYC documents for identity verification.

Once your account is set up, you can make contributions online through your bank or deposit cash at a branch. Remember, to keep the account active, you need to make at least one deposit every year.

Systematic Investment Plan (SIP)

If you are looking for an investment option through which your money grows gradually, then SIP is the answer. SIP, or Systematic Investment Plan, lets you invest a fixed amount regularly in mutual funds, even starting with just ₹100. While returns depend on the chosen mutual fund and market conditions, you can expect potential annual gains of 10-15% over the long term (especially for plans lasting 3-5 years).

How to invest in SIP?

Choose a platform like a bank or investment app. Pick a mutual fund that fits your goals, then set up an automatic investment for a regular amount (even ₹100!). SIPs handle the rest, making investing convenient and automated.

Read More: A Guide To Nippon India Mutual Fund’s SIPs

Gold

Gold is something that every Indian invests in once in their lifetime. Gold’s price often moves in the opposite direction of the stock market, offering a hedge against inflation. Plus, gold prices tend to hold their value over time, minimizing capital loss. Investors can choose from physical gold (jewellery, coins, bars) or paper options like gold ETFs (traded like stocks) and sovereign gold bonds (government-backed). Expected annual returns from gold investments can range from 6% to 10%.

Why is it important to invest in Gold?

Gold as an investment option acts as a shield against inflation, rising in value when everyday costs climb. It also diversifies your portfolio, potentially balancing things out if the stock market dips. Moreover, gold offers long-term value, although it doesn’t always rise or provide income.

Read More: Significance of Market Research Before Investing in Stocks

Mutual Funds

A mutual fund is an investment tool that pools money from multiple investors and uses it to invest in different stocks, bonds, and other securities. In addition to this equity mutual funds give higher returns by investing in different stocks in various sectors. The expected returns from equity mutual funds range from 12% to 18 % annually.

Why should you invest in Mutual Funds?

As an investor, you may not have the knowledge and resources to purchase individual stocks or bonds. In such a situation, your mutual funds are managed by a full-time, professional money-maker who has the prerequisite expertise, experience, and resources to buy, sell, and monitor investments.

Other benefits include risk diversification, affordability, liquidity, low cost, and well-regulated by SEBI (Securities and Exchange Board of India). Additionally, investment in ELSS up to Rs 1,50,000 qualifies for tax benefit under 80C of the Income Tax Act 1961.

Also Read: 5 Things To Consider Before Getting A Gold Loan

Summing Up

The article explores various investment options that aim to guide readers towards safer investment plans. It covers Mutual Funds, Fixed Deposits (FDs), National Pension System (NPS), Public Provident Fund (PPF), SIPs and Gold.

Frequently Asked Questions

Is investing in SIP safe?

SIPs are considered safe as they allow for disciplined investing in mutual funds, but they are subject to market risks.

Which investment option is better, FD or SIP?

Whether SIP is better than FD depends on investment goals, horizon, and risk tolerance. SIPs offer higher potential returns with more risk, while FDs provide stable, but usually lower returns.

Also Read: What’s Your True Financial Standing: Calculating Net Worth

Whether a SIP can incur loss depends on the performance of the mutual fund in which the SIP is invested.

Which SIP gives a 15 % return?

DSP Flexi Cap Fund Direct Plan-Growth has provided an average annual return of 15.66% since its launch. The minimum investment in this is 500 rupees.

What is the locking period of SIP?

The Lock-in period of SIP is three years.

What is the difference between mutual funds and SIPs?

SIP is a disciplined way to invest in mutual funds with fixed instalments. While a mutual fund is the actual investment option you choose.

What are the four types of Mutual Funds?

The four types of Mutual funds are:

- Equity Funds

- Debt Funds

- Money Market Funds

- Hybrid Funds

What is a hybrid mutual fund?

Hybrid mutual funds are an investment fund that spreads its assets across various sectors.

What is the full form of NFO?

NFO stands for New Fund Offer. It is a subscription offer for a new mutual fund scheme launched by an Asset Management Company (AMC).

What is the full form of ETF?

An ETF or exchange-traded fund, is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund.