Managing money has become easier, faster, and far more convenient than ever before. As digital banking continues to transform how people save, spend, and invest, one product has grown rapidly in popularity—the zero balance savings account. Whether it’s for beginners, students, young professionals, gig workers, or anyone who prefers a simple banking experience, a zero balance account removes the pressure of maintaining a monthly minimum balance. Today, banks are offering smarter, digital-first solutions that make banking accessible for millions across India.

One such modern offering is from Roarbank – an initiative by Unity Small Finance Bank Limited, which has introduced a seamless, user-friendly, and secure zero balance savings account designed for the new-age customer.

What Is a Zero Balance Savings Account?

A zero balance savings account is a type of bank account where customers are not required to maintain a monthly minimum balance. Traditional savings accounts often require users to keep a fixed average balance, failing which penalties are charged. However, a zero balance account removes this stress, allowing users to operate the account freely regardless of the remaining funds.

This type of account is especially useful for:

- Students

- First-time earners

- Freelancers or gig workers

- Homemakers

- Daily wage earners

- Individuals looking for a secondary account

- People who want simple, penalty-free banking

The absence of balance requirements makes it one of the most inclusive financial products in the country.

Why Choose a Zero Balance Savings Account?

There are many reasons why a zero balance savings account has become a preferred banking choice. Here’s what makes it valuable in today’s fast-moving financial landscape:

- No Penalties or Balance Stress

The biggest advantage is the complete freedom from monthly average balance (MAB) requirements. Users can keep funds as low as needed without worrying about charges.

- Instant Digital Onboarding

Many banks now permit complete on-line account starting via KYC verification. Users can complete the system in minutes the usage of their cellphone.

- Secure and Convenient Banking

Modern virtual banks cognizance heavily on safety, imparting OTP-based authentication, tool-degree protection, and sturdy encryption to make certain secure transactions.

- Easy Access to Banking Services

Despite being a zero balance account, users still get access to:

- UPI payments

- Net banking

- Mobile banking apps

- Debit cards

- Fund transfers

This offers all the benefits of regular banking without the burden of maintaining a balance.

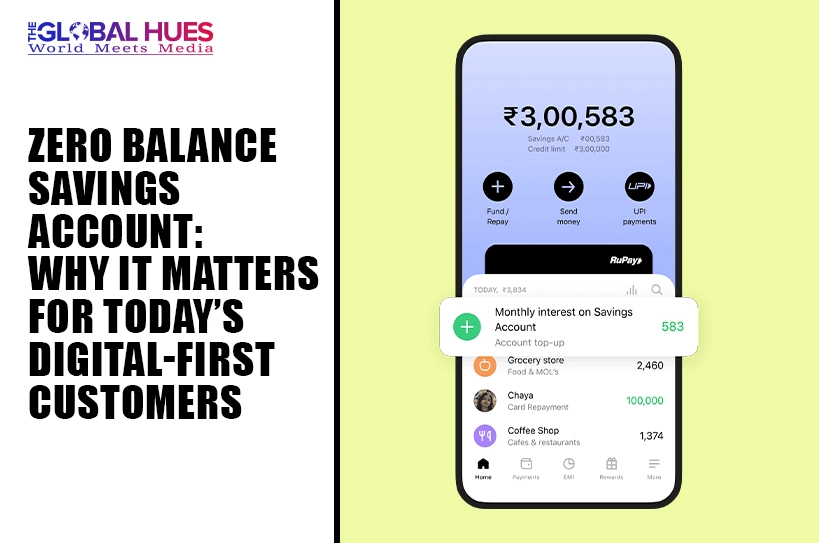

Roarbank’s Zero Balance Savings Account: Built for Modern India

When choosing a savings account, trust, digital reliability, and user experience matter the most. Roarbank – an initiative by Unity Small Finance Bank Limited provides a next-generation zero balance savings account designed for individuals who prefer fast, digital, and transparent banking.

Their digital-first ecosystem focuses on accessibility, ease of use, and strong security, making it a standout choice for anyone looking for a hassle-free savings account.

Key Features That Make Roarbank a Strong Option

Here are some of the advantages offered by Roarbank – an initiative by Unity Small Finance Bank Limited for users looking for a smart, penalty-free banking solution:

- Fully Digital Account Opening

Customers can open their account absolutely on-line without journeying a department, decreasing paperwork and lengthy ready instances.

- Zero Balance Requirement

There is no pressure to maintain a fixed monthly balance, making the account suitable for people from all walks of life.

- User-Friendly Interface

Roarbank presents a smooth digital revel in via its intuitive platform, allowing handy transactions and account management.

- Enhanced Security & Transparency

With stable virtual structures and constant recognition on transparency, clients can bank with a bit of luck without hidden prices or unpredictable expenses.

- Accessibility for All

Whether you’re a student, a freelancer, a new salary earner, or someone seeking a secondary account, this product fits your needs seamlessly.

Who Should Consider Opening a Zero Balance Savings Account?

A zero balance account is ideal for individuals who want flexibility in banking. It caters especially to:

- Students beginning their financial journey

- Salaried employees who want a secondary account

- Freelancers or gig workers with irregular income

- Retired individuals seeking simple banking

- Homemakers managing household finances

- Digital-first customers who prefer mobile-based banking

Its simplicity makes it a perfect entry point for India’s fast-growing digital banking population.

How to Get Started with Roarbank’s Zero Balance Account

Opening an account with Roarbank – an initiative by Unity Small Finance Bank Limited is easy and fully online. Typically, the process requires:

- A smartphone

- Aadhaar-linked mobile number

- PAN card

- Basic personal details

Within minutes, customers can begin transacting, saving, and dealing with money digitally.

Conclusion

A zero-balance savings account is one of the smartest and simplest methods to begin your banking adventure without the worry of consequences or complicated balance necessities. As India continues to undertake digital banking solutions at lightning speed, such debts convey inclusivity, ease, and monetary self-belief to hundreds of thousands.

With depended on and user-friendly alternatives like Roarbank – an initiative by means of Unity Small Finance Bank Limited, customers get a current, steady, and flexible banking experience optimized for the virtual age. If you’re looking for a dependable savings account with zero balance stress, reachable capabilities, and a smooth digital process, this is probably the ideal banking answer for you.

(DISCLAIMER: The information in this article does not necessarily reflect the views of The Global Hues. We make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information in this article.)