The smartphone has become a pocket bank. It sits in your hand as naturally as a wallet in your pocket. The difference is speed and flexibility.

Fintech apps move money in seconds. No branch visits. No lines. Two taps and the bill is paid.

Crypto apps add a new level of control. They work without a bank in the middle. The user holds the keys. It is like carrying a personal safe at all times.

Modern users value three things: speed, control, and mobility. They order a taxi in a minute. They sign documents online. They expect the same from their money.

Mobile fintech and crypto services combine payments, investments, currency exchange, and digital tools in one interface. The phone becomes a financial hub.

How Mobile Apps Combine Finance And Entertainment

Financial apps no longer focus only on transfers. They open access to new earning models and digital services.

Some platforms merge crypto wallets, betting markets, and gaming mechanics in one space. The user manages funds and applies them to active strategies. It feels like a trading terminal in your pocket.

If a person understands sports and studies statistics, they can apply that knowledge to decision-making. The same applies to esports or any field where analysis and discipline matter.

For example, through bc game apk, users can access crypto betting and gaming formats directly from a smartphone. Digital assets remain under user control while strategies are executed in real time.

The phone becomes a tool that connects capital, analytics, and digital interaction.

Key Advantages Of Mobile Fintech And Crypto Apps

Mobile services shorten the distance between decision and action. Tap once, and the transaction runs. No paperwork. No waiting.

The app is always within reach. It works like an ATM that never closes.

Main advantages include:

- Instant transactions. Transfers take seconds.

- Direct control. Users manage assets themselves.

- Lower fees. Crypto transactions often cost less than bank transfers.

- Global access. No borders limit activity.

- Flexibility. Funds can be stored, moved, or applied in digital services.

- Transparency. Blockchain records every operation.

Money begins to move as fast as the user.

Fintech Vs Traditional Banks: What Is The Difference

A bank is physical infrastructure. Offices. Staff. Procedures. Processes often take time.

A mobile app works differently. It automates operations and shifts them online.

| Criteria | Traditional Bank | Mobile Fintech/Crypto App |

| Account Opening | In-person visit | Online in minutes |

| Access | Business hours | 24/7 |

| Transfer Speed | Hours or days | Seconds or minutes |

| Fees | Often higher | Usually lower |

| Control | Bank-managed | User-managed |

| Geography | Jurisdiction-based | Global access |

The key difference is user autonomy.

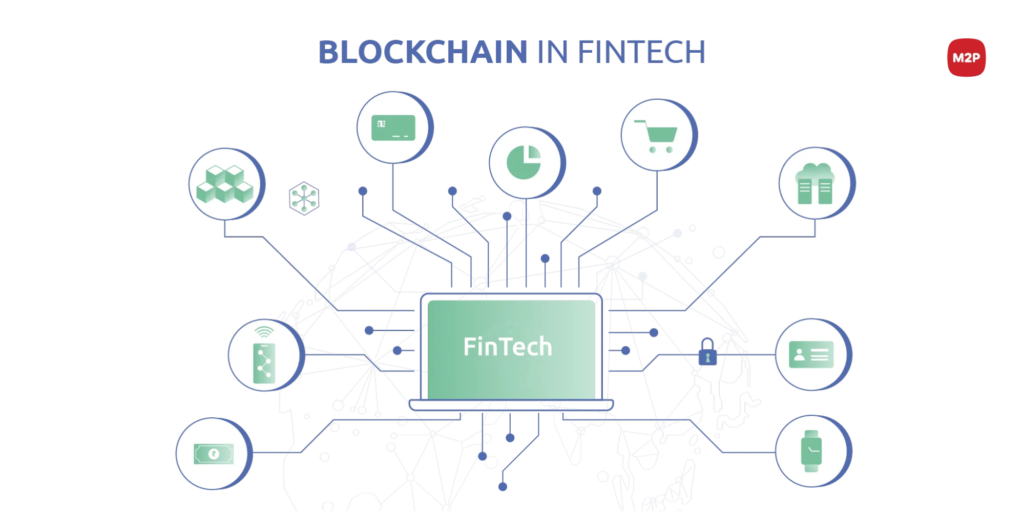

The Role Of Crypto Platforms In The Mobile Economy

Crypto platforms expand mobile capabilities. They combine payments, asset storage, and digital markets.

Transactions run through blockchain networks. Records cannot be altered after confirmation. This builds a transparent structure.

Through bc game, users gain access to crypto betting and sports markets inside one digital environment. Assets remain in digital form and under personal control.

This approach changes how capital works. Funds do not sit idle. They move and respond in real time.

Skills Required To Use These Apps Effectively

Technology provides the tool. Results depend on the user.

To use mobile fintech and crypto services wisely, a person needs:

- Financial discipline. Clear limits and budgeting.

- Basic crypto knowledge. Understanding blockchain and network fees.

- Analytical thinking. Ability to read and compare data.

- Risk management. Capital control without impulse.

- Digital security habits. Strong passwords and two-factor authentication.

- Calm decision-making. Actions based on numbers, not emotion.

An app strengthens competence. It does not replace it.

Why Mobile Format Becomes The Standard

Life moves fast. Finance must move at the same pace.

A smartphone provides instant access. Biometric login replaces signatures. Notifications show updates in real time.

Users see price changes immediately. They react without delay. Speed creates advantage.

Finance is no longer a place. It is a function inside a device.

Conclusion: The Smartphone As A Personal Capital Center

Mobile fintech and crypto apps reshape money management. Funds become mobile and flexible.

The smartphone turns into a financial command center. Users transfer assets, monitor markets, and apply knowledge from one screen.

The core benefit is control and speed. Decisions happen directly and without intermediaries.

Those who understand markets and manage risk gain a real-time tool. The financial system fits in the palm of the hand and responds instantly.

(DISCLAIMER: The information in this article does not necessarily reflect the views of The Global Hues. We make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information in this article.)