Discover

-

What is Buy Now & Pay Later (BNPL)?

-

How does BNPL work for purchasing items?

-

Which BNPL apps are popular in India?

-

Can you use BNPL services to book flights?

Imagine you are online and find the perfect dress, book, phone, or any other item you want to buy. But it is month end and you are on a fixed budget, so what will you do? Just click on the Buy Now & Pay Later option. But what exactly is this service, and what are its benefits and drawbacks? Let’s learn more about this through this article.

What is Buy Now & Pay Later?

In today’s fast-paced world, the way we shop and manage our finances is evolving rapidly. With the rise of Buy Now, Pay Later (BNPL) services people can make purchases immediately and pay over time, often without the need for a credit card or upfront payment. Whether you are eyeing a new gadget, booking a flight, or looking for ways to manage your budget, BNPL options are becoming increasingly popular.

Buy Now & Pay Later (BNPL) is an alternative payment method that allows customers to purchase products and services without having to pay full money in one go. This way, the customers can buy what they need and pay for it in fixed installments over time.

Let us understand this through an example; you find a trendy new smartphone priced at Rs 30,000. Instead of paying the full amount right away, you opt for a Buy Now, Pay Later option. This allows you to buy the phone and pay Rs 5,000 for the next six months. According to research, India’s Buy Now & Pay Later market size is estimated to grow at a rate (CAGR) of 10.20% during 2024-2032.

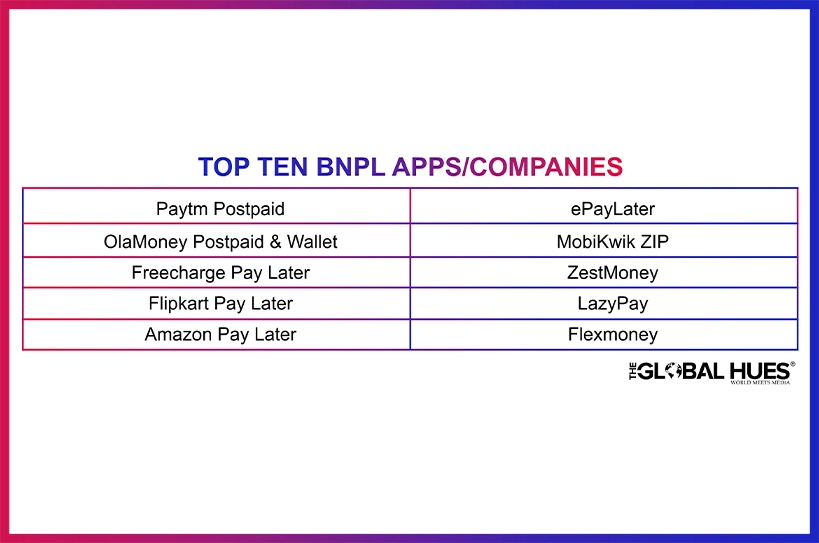

Top Ten BNPL Apps/Companies

Do flights also offer Buy Now, Pay Later services?

Yes, along with doing shopping online, you can also book your flight tickets using this service. Alternative Airlines is an example of that, where you can book flights on over 650 airlines such as United, British Airways and American Airlines and pay later using Affirm, Klarna, Zip, Afterpay, Clearpay, Postpay and Tabby. Furthermore, Air India offers the Buy Now and Pay Later services.

What is BNPL’s no credit check?

Instant credit is given to consumers under the BNPL schemes. This feature lets shoppers buy items without traditional credit checks and get instant approval. Additionally, some BNPL websites offer their services without traditional checks. Instead of relying on credit scores, they rely on factors like income, spending habits and existing loans to decide if you qualify or not.

BNPL services come with several advantages and disadvantages, below are a few of them:

Advantages of BNPL Services

- Boost Your Shopping Confidence

With the help of Buy Now Pay Later services, you can shop without the worry of paying the full amount upfront. It works like other payment methods but gives you time to save up for extra payments.

- Easy Sign-Up Process

Platforms like LazyPay make it easy to get started. BNPL is easy to use because it requires no paperwork. You don’t need to share your monthly salary or have good credit. To use BNPL, just sign up with a provider and complete a quick KYC check.

- Zero Processing Charges

BNPL services don’t have the processing fees that traditional credit systems have, making this payment method more affordable and convenient.

- No Additional Fees

BNPL options don’t have extra fees or costs. Everything is clear from the beginning so that customers can make informed choices. However, if you miss a payment deadline, interest will be added.

Disadvantages of BNPL Services

- Impulsive Spending & Buying

BNPL services can lead to impulsive buying and overspending. By breaking down large payments into smaller EMIs customers can end up buying things they don’t need, possibly developing a shopping addiction.

- Delayed Payment Fines & Interest Fees

While BNPL services offer interest-free plans, they also charge late fees, missed payments and insufficient funds. A late fee is applied daily until the customer pays the money.

- Potential For A Low Credit Score

Using BNPL services doesn’t help improve your credit score, but missed or late payments can negatively impact your credit history.

- Increased Merchant Fees

Companies that offer BNPL services charge merchants a fee for each transaction, typically between 2 to 6 per cent of the total purchase amount. These fees are higher than those for traditional payment methods.

- Boosts Consumer Debt

Buy Now Pay Later services can encourage customers to buy more than they can handle, putting them at risk of debt. Missed or late payments can harm their credit scores and cost retailers money.

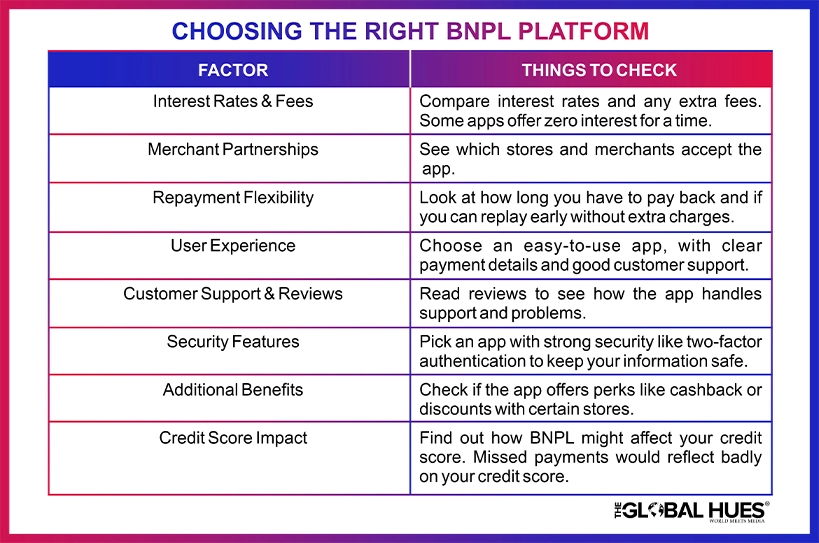

Keeping in mind these advantages and disadvantages, below is a table that helps us understand how to choose the right BNPL platform.

Choosing The Right BNPL Platform

The Bottom Line

Buy Now, Pay Later (BNPL) services are transforming how we shop and manage our finances. They let you purchase items immediately and pay over time without needing a credit card or paying everything upfront. Are you thinking of buying now and paying later? What would you like to buy?

Frequently Asked Questions

- Is Buy Now, Pay Later legal?

At present, the Reserve Bank of India (RBI) does not regulate Buy Now Pay Later (BNPL) products.

- Does Amazon use BNPL?

With Amazon Pay and Affirm, customers can get exactly what they want while making budget-friendly payments.

- Who uses BNPL in India?

LazyPay, Paytm Postpaid, Zest Money, Freecharge and Simpl are the major companies operating in India that use Buy Now Pay Later services.

- Does Amazon Pay Later have a limit?

In India, the maximum limit is typically Rs 60,000 which can be used to purchase goods on Amazon and pay for them later in installments.

- What is the limit of BNPL?

The credit limit offered under BNPL may also vary from provider to provider. For example, Flipkart offers a seamless checkout process for up to Rs 10,000. While ZestMoney and other BNPL lenders offer a personalised limit of Rs 60,000 to their users.