Track every major update on reliance jio ipo news with analysis on pricing, growth forecasts, and investment potential exclusively at The Global Hues. When Mukesh Ambani announced at Reliance’s AGM that Jio would list by the first half of 2026, he didn’t just set off financial fireworks; it meant much more than that. This move is a strategic lever to supercharge Jio as a leading AI-platform business.

For retail investors, founders, and ecosystem players, this IPO could reshape India’s capital markets and tech landscape in tectonic fashion.

Ambani’s confirmation that Jio is headed for a public listing by mid-2026 shows how seriously Reliance is banking on the telecom arm. At the same time, Jio is being architected as a platform for cloud, AI, and broad digital services.

Reliance is building around the thesis of “AI everywhere for everyone,” deploying its 5G infrastructure, expanding home broadband, and bundling digital services like Jio Smart Home and Jio TV OS to drive this vision.

The IPO is a signal that Reliance wants Jio’s future growth, especially in deep technology.

Why is Reliance Pushing for a Jio IPO?

- Jio’s financial performance is strong

- India’s digital growth is booming

- Reliance wants to build a massive AI ecosystem

Jio’s FY25 performance

Q4 FY25 Highlights

- Operating Revenue: ₹33,986 crore

- EBITDA: ₹17,016 crore

- ARPU: ₹206.2/month

- New Subscribers: 6.1 million added

- Total Users: 488.2 million

- Data Traffic: 49 exabytes (up 19.5% YoY)

- Revenue from operations stood at Rs. 33,986 crore, and EBITDA came in at Rs. 17,016 crore.

- The ARPU (average revenue per user) was Rs 206.2/month

- 6.1 million new users were added, taking the total count to 488.2 million users.

- Data traffic surged ~19.5% YoY to ~49 Exabytes in Q4, driven by rising 5G adoption and home broadband.

These growing figures clearly show that Jio continues to expand its customer base, increase its earnings per user, and handle massive amounts of data.

Value expectations

While Reliance hasn’t disclosed a target valuation as of now, financial analysts and experts project some directional benchmarks:

- According to the Financial Times, some expect Jio’s valuation to be around US$112 billion at IPO.

- A Jeferries analysis suggested that to deliver ~10% ROI to investors, Jio might need to target around US$118 billion by March 2026.

No matter what the numbers are, this could easily become one of India’s largest-ever tech IPOs.

Establishing Jio as a platform

Reliance’s vision for Jio is evolving fast. Here’s how the strategy is shaping up:

-

Connectivity backbone

Jio already has one of the largest customer bases in the world with 488 million+ subscribers. Almost 191 million of them are active 5G users, which means Jio has created the biggest 5G community in India.

The scalability of Jio has gone so high that it gives an unmatched advantage.

- With nationwide 5G coverage, Jio can offer faster speeds and more stable connections.

- Because Jio controls both the network and the infrastructure, it can build digital products that work smoothly without depending on other players.

-

The growth of smart homes

Jio is no longer focusing only on mobile customers. The company is aggressively expanding into homes and office spaces. JioFiber and Jio AirFiber are connecting millions of Indian homes. However, Reliance is aiming for much bigger. It plans to turn regular homes into digital-first smart homes. This includes smart appliances, Jio home automation tools, Wi-Fi mesh networks and entertainment services like JioTV+ and JioCinema.

Ambani’s idea is simple. If Jio powers your home internet, it should also power everything that runs on it.

For businesses, Jio wants to become a long-term technology partner. It is heavily investing in cybersecurity, Internet of Things (IoT) solutions, cloud platforms and private 5G networks for factories, hospitals, and large enterprises.

For companies, working with Jio means faster digital adoption, lower technology costs and local, secure and compliant infrastructure.

-

AI and intelligent play

Perhaps the biggest push is in artificial intelligence. Reliance has announced a new subsidiary called Reliance Intelligence, which shows how seriously the company is investing in artificial intelligence.

AI needs three things- Data, scale and infrastructure. Jio has all three. With hundreds of millions of users and massive data consumption, Jio’s network provides the perfect environment to develop and deploy AI at scale.

Reliance is not building this future alone. It has brought global leaders into the picture. Meta is working with Jio to develop AI-driven tools and consumer applications. It has also partnered with Google Cloud to provide powerful computing capabilities.

Impact on Telecom, Media and Retail sectors

Telecom Sector

A successful Jio IPO could re-rate the entire telecom sector. If Jio hits a high valuation, it will set a benchmark for other telcos like Bharti Airtel. They will likely be compared against Jio’s numbers, pushing them to upgrade their own performance.

A high-impact IPO could also push the whole sector into a new investment cycle. This would mean more spending on 5G expansion and edge data centres. In short, the bar for competitive infrastructure will rise.

Media & Entertainment

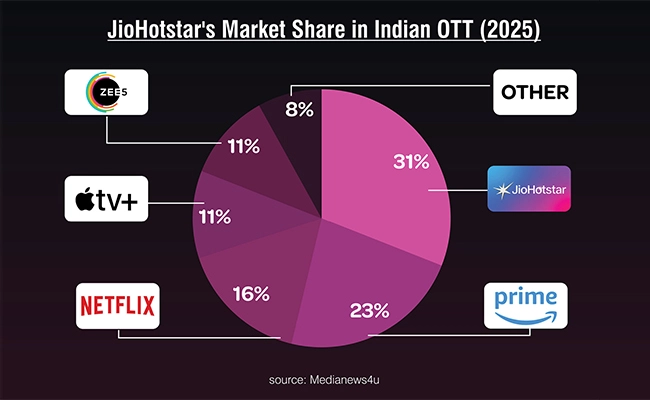

Once Jio becomes a public company, its media platforms like JioStar and JioTV+ could get access to more capital. That means faster scaling, bigger content libraries, and bold experiments in bundling.

Further, this would heat up competition in India’s OTT market. With Jio investing aggressively, other platforms will need to improve content quality and rethink pricing strategies.

Retail & Commerce

JioMart could become one of the biggest winners from the IPO. More capital means stronger execution in hyperlocal deliveries, logistics expansion, and online-to-offline (O2O) retail models. For startups, a publicly listed Jio becomes an even more attractive partner. Companies in fintech, retail tech, logistics, and AI may find more collaborative opportunities across payments, cloud tools, and customer acquisition channels.

Once the IPO is live, retail investors and Institutional investors are likely to view Jio as a trustworthy brand, something that gives confidence, especially to first-time market participants.

Roadblocks and risks

Even though the Jio IPO story is exciting, there are real challenges the company has to address and solve.

- Regulatory risk: Telecom is one of the most tightly regulated sectors in India. If the government changes spectrum rules or pricing, Jio’s costs can shoot up. On top of that, setting up a clean structure for the IPO, whether it’s a direct listing or a demerger, is a complex task. The company must make sure the process protects Reliance’s value while still keeping the offer attractive for new investors.

- Competition: Jio is not operating alone. Rivals like Airtel and global tech companies working in cloud and AI could intensify the competitive landscape. Large global cloud players might even start seeing Jio as a direct competitor rather than a partner, especially as Jio deepens its tech stack.

- Macroeconomic Risks: Global and domestic market conditions can disrupt even the strongest IPO story. Higher interest rates, market volatility, or a slowdown in the global economy could affect how investors value Jio at listing.

- High Capital requirements: The vision of Jio around AI, cloud, and edge computing needs huge investment. Building data centres, running a nationwide 5G network, expanding home broadband, and supporting new enterprise services are all expensive and continuous commitments.

What does this shift really mean?

For India’s startup ecosystem, the Jio IPO and Reliance’s aggressive push into “Intelligence” could open a new wave of opportunities. Whether you are building, funding, or scaling, this moment could reshape how you plan your next move.

Room for new products

With Jio investing heavily in 5G, data centres, and new digital tools, the ecosystem opens up space for fresh ideas, from AR/VR to smart devices to real-time analytics. Startups that align with this vision could get access to more customers, more visibility, and more room to scale.

Access to millions of users

Jio has one of the largest user bases in India. If a product gets visibility on any Jio platform, its growth can accelerate very quickly. For investors, this means startups connected to Jio could scale faster than usual.

More money in the startup ecosystem

A big IPO usually boosts confidence in the entire tech ecosystem. If Jio raises a large amount of capital, some of that spending will spill over into areas like telecom tech, fintech, media, cloud services, and logistics. This gives founders a better environment for funding and experimentation.

Possibilities of Mergers & Acquisitions

Jio may also look forward to technologies that it doesn’t want to build from scratch. This means startups with strong products, especially in AI, cloud, security, commerce, or content, could become acquisition targets.

The bottom line

Reliance’s announcement to take Jio public by mid-2026 is not a routine capital-markets maneuver. It marks the opening of a new chapter, where Jio becomes a platform for the AI-era. For investors looking to ride India’s digital wave, and for founders seeking powerful partners, this might be the defining story of the decade.

Takeaways

- The Jio IPO could change the game, not just for Jio but for the whole tech and telecom space.

- Going public may unlock huge value for Reliance and everyday investors.

- Jio’s strong FY25 performance and big plans in AI show it still has a long growth journey ahead.

- As Jio shifts from a telecom company to a tech platform, it could create new opportunities for startups and partners.

- There are still risks, from regulations to market challenges, so the outcome isn’t guaranteed.