“Adani Wilmar has begun a new journey. I thank our investors for their incredible confidence in yet another IPO from the Adani Group. For 23 years, we and our partner Wilmar have served millions of consumers and we will continue our mission to build a Healthy Growing India,” wrote the billionaire Industrialist Gautam Adani in a Tweet while emphasizing on its listing on the bourses – BSE and NSE.

India has a new leader in its FMCG market. The name is quite obvious to guess – Gautam Adani’s Adani Wilmar. One of the largest FMCG companies in India, Adani Wilmar (a joint venture between the Adani Group and Wilmar International of Singapore) has surpassed the 88 years old Hindustan Unilever.

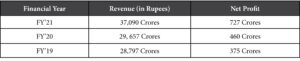

The company’s consolidated net profits for the Quarter ended March stood at a staggering Rs. 234.29 crore. The investors believe that Adani Wilmar will benefit from soaring edible oil prices and has thus witnessed multiple spikes in its shares.

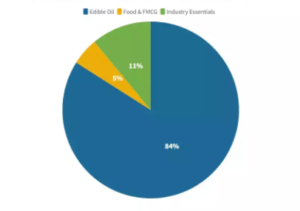

Edible oil contributes the highest in revenue generation and stands at Rs 45,401 crore. It is nearly 84% of the topline and leading the sales of the company. “We have delivered steady growth despite the challenging macro environment. The food & FMCG segment registered double-digit growth. We have continued to improve our market share across edible oil & food categories,” said Angshu Mallick, Managing Director and CEO of Adani Wilmar.

WILMAR INTERNATIONAL AND THE INCEPTION OF ADANI WILMAR

Wilmar International is one of Asia’s leading brands in the fast-moving consumer goods (FMCG) market. Wilmar was founded in 1991, by Kuok Khoon Hong and Martua Sitorus. The company is headquartered in Singapore and has over 500 manufacturing plants and a large-scale distribution network in more than 50 countries including China, India, and Indonesia.

In January 1999, Adani Wilmar Limited was incorporated as a 50:50 joint venture between Indian multinational business conglomerate Adani Group and Singapore-based Wilmar. At present, AWL owns more than 40 units that cumulatively translate to a refining capacity of over 16800 tonnes per day, seed crushing capacity of 6000 tonnes per day and packaging capacity of 12900 tonnes per day.

Adani Wilmar’s most renowned brand is ‘Fortune’, which is the largest edible oil brand in India. Other brands include King’s, Bullet, Raag, Avsar, Pilaf, Jubilee, Fryola, Alpha, Alife and Aadhar. The company has a wide range of products such as wheat flour, sugar, pulses, Basmati rice, and many more to list. Today, Adani Wilmar’s share has a decent reputation and is doing pretty well in the market.

ACQUISITION OF KOHINOOR BRAND

Acquisition of the renowned brand of Basmati rice, Kohinoor, is a big move by Adani Wilmar. It announced the acquisition of Kohinoor on May 3, 2022. Prior to this, the company was led by US-based businessman, McCormick. The company hasn’t disclosed the consideration for the acquisition, however, it mentioned that the purchase was financed from the IPO (Initial Public Offering) proceeds.

This acquisition gives Adani Wilmar the right over Basmati rice and other ‘Ready to Cook’ and ‘Ready to Eat’ products in India. The company foresees this acquisition to strengthen its position in the market. Angshu Mallick said, “This acquisition is in sync with our business strategy to expand our portfolio in the higher-margin branded staples and food products segment.”

He also stated, “We believe the packaged food category is under-penetrated with significant headroom for growth. The Kohinoor Brand has a strong brand recall and will help accelerate our leadership position in the Food FMCG category.”

So, we can firmly say that with this move, Adani Wilmar eyes an exceptional portfolio of the company. It can surely help the company to scale its profit margin and witness holistic growth.

Also Read: The Success Story of Billionaire Industrialist Gautam Adani

LEADING BRAND OF EDIBLE OILS

Adani Wilmar is the leading brand of edible oils in India. The company has a wide variety of edible oils, including palm oil, sunflower oil, rice bran oil, mustard oil, groundnut oil, vanaspati and many more.

84% of the total sales are derived from edible oils. The contribution of this segment to the profits also stands apart from others. The total profit generated with edible oils was Rs, 1,289 crores in FY 2021 22.

Adani Wilmar Segment Revenue Contribution

However, the inflationary pressure in the oil industry is a big cause of worry, the CEO and Director, Mallick says, “never seen such higher prices of edible oil in the last five years.” The disruption in agricultural production and the supply chain leads to inflation of the prices. Geopolitical tension is also the reason behind the price inflation of oils. The CEO hints that the price of edible oils could fall upto 15% in June.

TURMOIL IN THE STOCK MARKET

The shares of Adani Wilmar enjoyed a lifetime high in the month of April. It crossed Rs 1 lakh crore market cap on April 26, 2022. Stock market experts said the share of Adani Wilmar skyrocketed because of the constraint in demand and supply of raw materials. After enjoying the surge in the market, the company’s shares saw a dip of over 22% at the beginning of May 2022.

Adani Wilmar is currently facing upheaval in the share market because the shares of Adani Wilmar have been put under ASM surveillance because the price of the shares was much higher than its actual valuation. The experts say that the stock price may fall down further until it is under surveillance.

The company is eyeing to expand in other areas as well. It is focusing on the acquisition strategy to scale its business. Mallick has recently stated, “We will continue to invest in our brand, distribution, sourcing and manufacturing capabilities. Going forward, we will focus more on inorganic growth and strategic investments in the foods space.”