Discover

-

What is the repo rate for the year 2024?

- How is the repo rate calculated?

-

Which year has the lowest repo rate?

-

What are the potential implications of consistent repo rates for borrowers, banks, and investors?

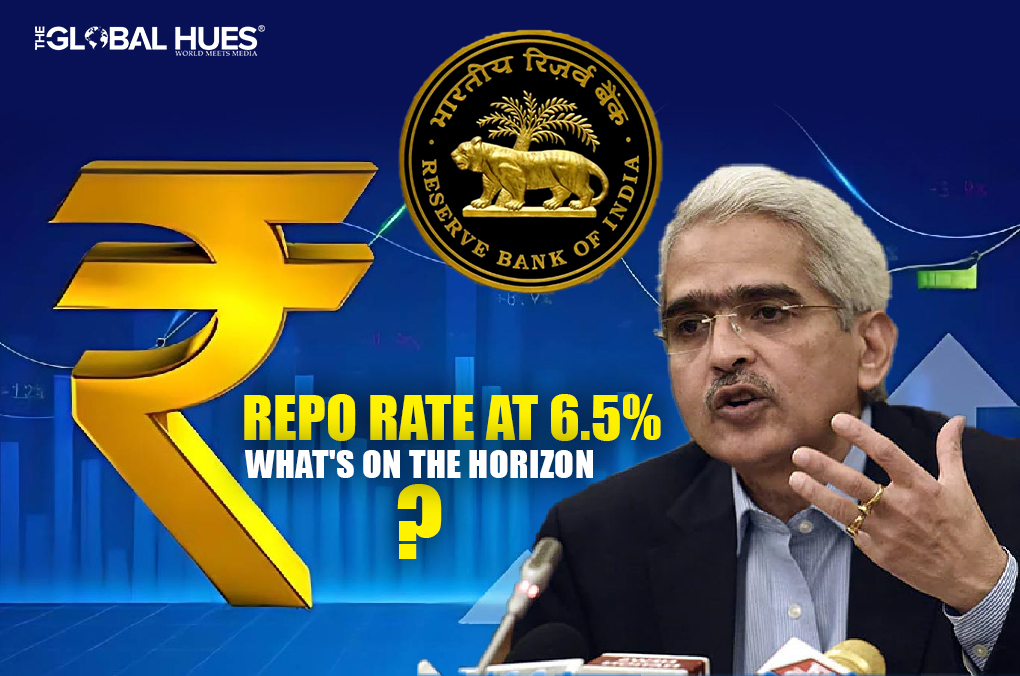

The Reserve Bank of India’s Monetary Policy Committee (MPC) has kept the repo rate unchanged at 6.5 per cent for the eighth consecutive time. This is the first time the MPC met after the Lok Sabha Election results were declared. Furthermore, addressing a press conference, RBI Governor Shaktikanta Das revised the GDP (gross domestic growth) projection to 7.2 per cent for FY 25. It is two points up from the 7 per cent that it had expected earlier.

What is the meaning of Repo Rate?

Repo Rate is the rate at which the central bank of any country, the RBI in the case of India, lends money to commercial banks in the event of any shortfall of funds. The term “repo” is derived from “repurchase agreement,” reflecting the contractual nature of the transaction. It involves a short-term loan where a commercial bank borrows money from the central bank by selling securities and buying them back at a slightly higher price the next day.

How does the repo rate work?

Imagine taking a loan from the bank, you pay interest back to the bank. Likewise, banks also pay interest when they borrow money from the central bank, like the Reserve Bank of India (RBI). This interest is called the repo rate. The RBI use the repo rate to control the amount of money in the market. When there is too much inflation, the RBI raises the repo rate.

Also Read: Guide To Obtaining A Good Private Or Hard Money Loan

How is the repo rate calculated?

The banks need to agree on a standard repo rate. This is the interest rate they pay when they borrow money from the Reserve Bank of India (RBI) or earn when they deposit money with the RBI.

The repo rate is calculated using this formula:

Repo Rate = (Repurchase Price – Original Selling Price ÷ Original Selling Price) x (360 ÷ n)

- Repurchase Price: The price at which the bank buys back the securities, which includes the interest.

- Original Selling Price: The initial price at which the bank sold the securities.

- n: The number of days until the loan is repaid.

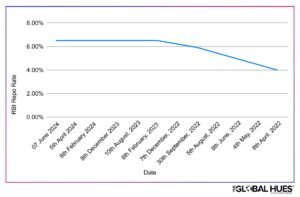

Changes In The Repo Rate Since 2022

Here is a table showcasing the changes in the repo rate done by the RBI since 2022.

| Date | RBI Repo Rate |

| 07 June 2024 | 6.50% |

| 05 May 2024 | 6.50% |

| 5th April 2024 | 6.50% |

| 8th February 2024 | 6.50% |

| 8th December 2023 | 6.50% |

| 10th August 2023 | 6.50% |

| 8th February 2023 | 6.50% |

| 7th December 2022 | 6.25% |

| 30th September 2022 | 5.90% |

| 5th August 2022 | 5.40% |

| 8th June 2022 | 4.90% |

| 4th May 2022 | 4.40% |

| 8th April 2022 | 4.00% |

What happens when the repo rate remains unchanged?

Below is a list of things that happen when the repo rate remains unchanged:

Loan Payments Stay The Same

With the repo rate being the same and not changing, loans like home loans won’t cost more each month. So, people won’t have to pay extra for their loans.

New Loans Keep The Same Interest

Since the repo rate is steady, new loans won’t have higher interest rates right away. Borrowers can expect the same interest for new loans.

Banks Don’t Pay More To Borrow

When the repo rate stays the same, it means banks pay the same amount to borrow money from the Central Bank. It helps banks manage their finances better.

Some Loans Might Get Pricier

Even if the repo rate stays the same, sometimes the banks can still make certain loans more expensive. It happens when the banks need more money or if they don’t pass on previous interest rate increases to borrowers.

Markets Remain Steady

Keeping the repo rate steady helps financial markets feel more stable and less uncertain as it signifies that the Central Bank believes in the existing economic conditions and monetary policies. Subsequently, it helps investors and businesses expect consistent borrowing costs and interest rates in the future, thereby facilitating better financial planning and investment decisions.

Stability In Savings & Investments

The repo rate being steady directly impacts the interest rate offered by banks. Specifically the interest rates on savings accounts, fixed deposits and other investment schemes offered by the banks. Similarly, for investors who have invested in bonds, mutual funds or stocks, the steady interest rate means that their investments won’t fluctuate significantly.

Summing Up

The Reserve Bank of India’s Monetary Policy Committee has decided to maintain the repo rate at 6.5% for the eighth consecutive time. Governor Shaktikanta Das revised the GDP projection to 7.2% for FY 25. This decision signifies stability in loan payments, interest rates, and borrowing costs for banks, promoting financial market stability and facilitating consistent investment planning.

Frequently Asked Questions

What is the repo rate today in RBI?

The repo rate has been at 6.5 per cent since February 2023.

What is the full form of repo?

Repo stands for ‘Repurchasing Option.’

What is NPA in banking?

NPA means non-performing assets. These are loans or advances issued by banks or financial institutions that no longer bring in money for the lender since the borrower has failed to make payments on the principal and interest of the loan for at least 90 days.

What happens if the repo rate increases?

If the repo rate increases, the interest rates on all types of loans increase as well.

Does the FD rate increase with the repo rate?

Yes, FD rates increase when the repo rate goes up because banks need to offer higher returns to attract funds from investors and compensate for higher borrowing costs.

Which banks are the best for fixed deposits?

Top banks like SBI, ICICI, HDFC, BOB, Kotak, and PNB offer competitive rates for 5-year FDs, ranging from 6.2% to 7%.