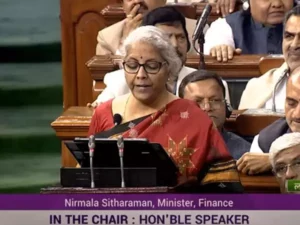

Finance Minister Nirmala Sitharaman presented the Union Budget 2025 for the financial year 2025–2026 in the Lok Sabha. She began her speech by highlighting India’s strong recovery and economic resilience in the face of global economic pressures during Prime Minister Narendra Modi’s third term.

Quoting renowned Telugu poet and playwright Shri Gurajada Appa Rao, she remarked, “A country is not just its soil; a country is its people.” With this message, the Finance Minister presented the Budget 2025–26 with the theme “Sabka Vikas”, aiming to stimulate balanced and inclusive growth across all regions of the country.

Presenting the Budget in a paperless manner, FM Nirmala continued her tradition started in 2019. The 2025–26 budget focuses heavily on tax relief for individuals, strengthening agriculture, empowering MSMEs, and boosting capital expenditure with a vision for inclusive growth.

This budget is seen as a critical milestone in the Amrit Kaal journey, building a roadmap toward India @100. The most discussed highlight of Budget 2025 is again Income Tax reform. FM Nirmala Sitharaman announced that individuals earning up to ₹12 lakh annually will now be exempted from income tax under the new tax regime.

In her speech, she declared, “To reward the growing aspirations of the middle class and salaried professionals, we have raised the tax rebate threshold from ₹7 lakhs to ₹12 lakhs under the new tax regime.”

Following is the new Income Tax Slab for salaried individuals (New Regime):

| Income Slab | Income Tax Rate |

| up to Rs 4 lakh | NIL |

| Rs 4 lakh- Rs 8 lakh | 5% |

| Rs 8 lakh-Rs 12 lakh | 10% |

| Rs 12 lakh-Rs 16 lakh | 15% |

| Rs 16 lakh- Rs 20 lakh | 20% |

| Rs 20 lakh – Rs 24 lakh | 25% |

| Over Rs 24 lakh | 30% |

The government believes the revised tax structure benefits both middle-income and higher-income groups. The move increases disposable income and is expected to fuel consumer spending and boost economic demand. Additionally, salaried and pensioned individuals can now avail a higher standard deduction of ₹75,000 under the new regime.

The new tax slabs are estimated to save:

-

₹80,000 for those earning ₹12 lakh,

-

₹1.10 lakh for those earning ₹25 lakh annually.

The tax benefits are expected to benefit over 1 crore additional taxpayers, providing a major relief not seen since 2014.

Key Highlights Of Union Budget 2025

- The outlay for the Pradhan Mantri Awas Yojana (PMAY) continues with enhanced allocation to support affordable housing.

- A six-year national programme for pulses and cotton to increase crop yields and reduce imports.

- Announcement of a ₹2.4 lakh crore investment in Indian Railways, reinforcing the government’s push for high-impact infrastructure.

- Capital Expenditure increased to ₹11.21 lakh crore, representing approx 3.4% of GDP, to support infrastructure-led growth.

- A Credit Guarantee Scheme for MSMEs is revamped, with more access to collateral-free loans to support small businesses and startups.

- A new Nuclear Energy Mission launched with a target of 100 GW by 2047.

- Gig and platform workers to receive ID-linked welfare benefits and better integration into formal economic frameworks.

- TDS threshold on rent increased from ₹2.4 lakh to ₹6 lakh per annum.

- Senior citizens to benefit from an increased TDS limit on bank interest to ₹1 lakh.

- Extension of the Income Tax return filing window from 2 years to 4 years for error corrections.

What People Have To Say

While many people, especially salaried professionals and middle-class taxpayers, are praising the government for major tax relief and higher standard deductions, others are voicing concerns over key economic challenges.

Arvind Kejriwal, Ex-C M of Delhi, said, “A large part of the country’s treasury is spent on waiving off the loans of a few rich billionaires. I had demanded … with the money saved … [for] middle class home loans and vehicle loans … farmers’ loans … income tax and GST rates should be halved. I am sad this was not done.”

Congress leaders have criticized the budget, calling it “pro-corporate” and said that there is not enough concrete support for farmers or daily wage workers.

On the other hand, PM Narendra Modi called the 2025 Budget a blueprint for “Viksit Bharat”. He praised the government’s focus on empowering rural women and entrepreneurs. “India’s middle class is the driver of growth. This budget rewards their aspirations and simplifies their financial burden,” said the Prime Minister.