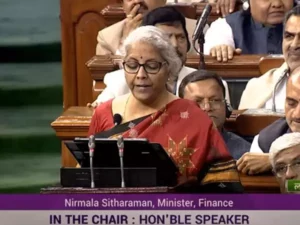

Finance Minister Nirmala Sitharaman presented the Union Budget 2023 for the financial year 2023-2024 in the Lok Sabha. She started her speech by explaining the economic situation of the country in the last few years under the Narendra Modi Government.

While presenting the budget, she mentions India has come a long way in economic growth and become 5th largest economy in the world.

Presenting the Budget in a paperless manner, FM Nirmala continues her tradition which she is following since 2019. The budget plan for 2023-24 increases the funds for the improvement of infrastructure, defence and logistics.

It is considered the first budget of Amrit Kaal which builds the foundation of building a new and developed India. The highlight of the Budget 2023 is Income Tax. The Finance Minister announces that individuals earning up to Rs 7 lakhs will be exempted from tax under the new tax regime.

In the budget, Nirmala Sitharaman announces, “The income rebate limit is increased to ₹7 lakhs from ₹5 lakhs in the new tax regime.”

Following is the new Income Tax Slab for salaried individuals:

| Income Slab | Income Tax Rate |

| up to Rs 3 lakh | NIL |

| Rs 3 lakh- Rs 6 lakh | 5% |

| Rs 6 lakh-Rs 9 lakh | 10% |

| Rs 9 lakh-Rs 12 lakh | 15% |

| Rs 12 lakh- Rs 15 lakh | 20% |

| Over Rs 15 lakh | 30% |

The Union Government believes that new income tax slabs directly benefit the lower or middle-income class. Raising the bar in the income tax group helps in increasing the disposable income of people in the country which eventually helps in more consumer spending. In addition to this, the new income tax regime is also beneficial for higher-income groups by enjoying a lower tax rate of 39% instead of 42.7%.

The tax rates have remained the same since 2014, therefore it’s a huge relief to salaried employees.

Key Highlights Of Union Budget 2023

- The outlay of the Pradhan Mantri Awas Yojna (PMAY) scheme is enhanced by 66% to 79,000 crores.

- The Finance Minister mentions that this budget may prove to be the blueprint for India @100.

- The investment plan in Railway is announced at Rs 2.40 lakh crore which is around 9 times higher than it was in 2013-2014.

- The Agriculture Accelerator Fund of Rs 20 lakh crore is set up to encourage modern agricultural practices and young startups.

- An increase of 33% (Rs 10 lakh crore) in capital expenditure. It would be approximately 3.3% of the GDP.

- The Budget announces revamping of a credit guarantee scheme for MSMEs with Rs 9,000 crores infusion. This scheme also enables additional collateral-free guaranteed credit of Rs 2 lakh crore.

What People Has To Say

While some people are praising the Government for giving Tax benefits to lower and middle-class people, some are criticising the government for neglecting crucial topics such as unemployment, curbing inflation and MSP for farmers.

Arvind Kejriwal, Chief Minister of Delhi, says, “Budget 2023 provides no relief to the common people of the country and there is no concrete plan for unemployment and inflation.” Congress leaders are claiming that it is a “Pro-Corporate Budget” and benefits only the corporate world.

PM Narendra Modi hails the special saving scheme for empowering women in rural and urban areas. “Women entrepreneurs, too, are eyeing tailored incentives and tax rebates from Union Budget 2023 to encourage the participation of women in business. It is also imperative to promote skill development and technological knowledge in women to accomplish the $5 trillion economy objective of GOI,” says Rachana Chowdhary, CEO of MVW-MSME Development Centre.

The Budget highlighted the Government’s efforts on development and economic growth since 2014. The Finance Minister says the Government successfully improved the quality of life in the last 8 years.