By Shivanand Pandit

Non-Banking Financial Corporations (NBFCs) due to their magnitude, intricacy, and interconnectedness are revolving systemically important over the years. NBFCs are the greatest net debtors of funds from the financial system and procured more than fifty percent of their funding from scheduled commercial banks. As a result, considering the topical strain in the sector and being stuck in inter-connections between NBFCs and banks, the stock markets, and other monetary sector units, the Reserve Bank of India (RBI) has sought to reassess NBFCs’ governing framework, embracing a scale-based tactic.

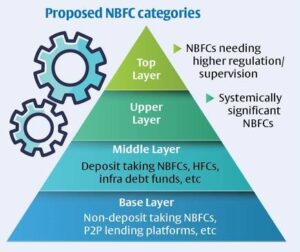

After its declaration in the December 2020 policy, the RBI has unconfined a discussion paper on the amended regulatory charter for NBFCs, in January 2021. The RBI in its discussion paper on “Revised Regulatory Framework for NBFCs – a Scale-Based Approach” mentioned its suggested framework could be envisaged as a pyramid, covering NBFCs classified in four coatings – Base Layer (BL), Middle Layer (ML), Upper Layer (UL) and a possible Top Layer (TL).

The discussion paper contains rules about the capital requirements, concentration norms, governance rules, and disclosure obligations for every layer. The RBI has recommended stringent standards and the formation of a multilayer model to safeguard financial solidity and diminish systemic jeopardies

Although there will be minimum controlling interference for NBFCs in the Base Layer, as one marches up the pyramid, the regulatory system will get harder and stricter. The framework proposes to stipulate Bank-like protocols for the top 25 to 30 NBFCs in India. To facilitate the NBFCs to design an execution plan, a time period of eight weeks will be offered to them. According to the RBI, within the assigned duration, the NBFCs should put in place a board-authorized strategy towards the implementation of the enhanced supervisory outline and such NBFCs should also be subject to obligatory listing requirements.

Four shades of the pyramid

Pc: Thehindubusinessline

In the preceding five years, size of the balance sheet of NBFCs has more than doubled from ₹20.72 lakh crore (2015) to ₹49.22 lakh crore (2020). Due to marvelous progress in the NBFC sector in recent years, the RBI has proposed a stiffer monitoring plan for the sector by creating a four-tier configuration with a progressive increase in the concentration of directive.

Base Layer (BL):

As per the discussion paper, the nature of the activity will be the basis for determining the base layer NBFCs. Therefore, NBFC-BL will consist of NBFCs which are presently categorized as non-systemically important NBFCs (NBFC-Non deposit-taking), besides Type I NBFCs which do not have either access to public funds or customer interface, Peer to Peer lending platforms (NBFC P2P), Non-Operative Financial Holding Company (NOFHC), Account Aggregators (NBFC-AA) and NBFCs up to ₹1,000 crore (raised from ₹500 crore) asset size.

Around 9,209 NBFCs will be in the BL. Low-level admission spot norms increase the likelihoods of failure resulting from weak governance of non-serious players, the central bank intends to amend these norms for NBFC-BL from ₹2 crore to ₹20 crores. The RBI suggests regularizing the existing non-performing asset grouping norm of 180 days to 90 days for NBFC-BL. The RBI mentioned that these NBFCs are dubious to pose any systemic risk on account of their activities and hence they can be controlled comparatively lightly.

Middle Layer (ML):

This layer contains NBFCs which are currently grouped as Non-Deposit-taking-Systemically Important (NBFC-ND-SI), Deposit-taking NBFCs, Housing Finance Companies, Infrastructure Finance Companies, Infrastructure Debt Funds, Standalone Primary Dealers, and Core Investment Companies. Although no amendments are prescribed in capital requirements for NBFC-ML the Apex bank has mentioned that connections of their exposure limits are planned to be altered from Owned Funds to Tier I capital, as is presently relevant for banks.

The existing credit concentration limits suggested for NBFC-ML for their advancement and investment can be combined into a single exposure threshold of 25 percent for the single borrower and 40 percent for a group of borrowers attached to the NBFCs Tier 1 capital.

Bearing in mind the misuse of the system by NBFCs in Initial Public Offer (IPO) financing the discussion paper recommended fixing a top limit of ₹1 crore per individual for any NBFC. However, they are allowed to choose more conservative bounds. Further, a sub-ceiling within the commercial real estate exposure limit should be set inside for funding the land purchase.

As per the paper, a few curbs are extended to NBFCs in ML, including not permitting them to offer finances to corporate entities for buyback of shares or securities, and rules on sale of strained assets by NBFCs will be altered on parallel lines as that for banks. The framework proposed that NBFCs with ten and more branches shall compulsorily be required to embrace Core Banking Solution. The paper suggested an unchanging term of three successive years applicable for statutory auditors of the NBFC and a functionally autonomous Chief Compliance Officer should be employed.

Upper Layer (UL):

This layer will be a new layer for regulation and consists of NBFCs that are recognized as systemically significant among them and will invite a new supervisory framework. This layer will be filled by NBFCs which have a large capacity of systemic spill-over of risks and can influence fiscal constancy. It is projected that a total of not more than 25 to 30 NBFCs will fill this layer and the monitoring structure for NBFCs falling in this layer will be bank-like with proper adjustments.

It is sensed that Common Equity Tier (CET) 1 capital could be announced for NBFC-UL to improve the worth of regulatory capital and it is advised that Common Equity Tier may be stipulated at 9 percent within the Tier I capital. Intending to tweak regulatory charter for NBFC-UL to larger sensitivity, the discussion paper recommended that NBFCs in this layer should be imposed differential normal asset provisioning at par with the banks and intends to extend a suitable version of the Large Exposure Framework as pertinent to banks.

As a result, the top NBFCs will move to distinguished standard provisioning norms as against the fixed 0.4% on par with banks. Consequently, NBFCs with greater exposure to commercial real estate may have to carry upper provisioning than before.

Considering the ability of NBFCs lying in this layer to produce hostile systematic risks the Central bank thinks that the governing outfits can be adjusted at par with the private banks and NBFCs should be subject to the obligatory listing condition and should follow the consequential Disclosures Requirements and Listing Obligations.

This layer will be formed based on a variety of factors such as size, inter-connectedness, intricacy, and managerial inputs which include the type of liabilities, group structure, and segment penetration. 35%, 25%, 10%, and 30% weightage will be given to these parameters respectively. As per the RBI, top ten NBFCs such as Bajaj Finance, LIC Housing Finance, etc will spontaneously fall in this class.

NBFCs in this layer will also have to obey the leverage requirement. The leverage ratio is calculated as Tier 1 capital divided by the bank’s exposures and therefore an increase in exposure would lead to a reduction in LR. The RBI proposes an appropriate limit to be laid down for this layer.

Top Layer (TL):

At present this layer will remain vacant. Careful administrative decisions may push a few NBFCs to this layer from the upper layer of the systemically significant NBFCs for superior control or supervision. Thus, if there is a systemic risk observed from particular NBFCs in the UL, the Central Bank can force a few NBFCs to enter the TL.

Nip in the bud

Pc: Quora

The Central Bank’s framework to constrict inspection of large NBFCs is crucial for fiscal steadiness. The shift from a common line of light touch control to one that screens larger players almost as closely as it does banks is a welcome move. This could be the biggest refurbishment of the governing structure for such finance companies or shadow banks in over twenty years if executed effectively.

Easier and liberal regulations have given NBFCs the elasticity to meet a series of financial requirements such as housing loans, microfinance, and huge infrastructure plans and as a result, the sector has witnessed tremendous growth. However, it has also manifested into a systemic risk and the risk was visible when one of the major infrastructure investment-centered NBFC players, IL&FS, tattered in 2018, with its payment evasions catalyzing a disaster for the whole sector. Due to this NBFCs could not nurture funds easily and confronted liquidity burdens that worsened solvency concerns in some illustrations.

Therefore, the RBI’s planned supervisory reaction to NBFC sector letdowns is the most wanted step which targets to strike a balance among the need to nimble and mollify systemic risks, with a four-tiered regulatory outline. Due to anguishes of the banking sector over the past two years, an all-inclusive reboot of the supervision system for NBFCs is essential to recollect the confidence and preserve financial solidity. It is hoped that the blueprint for the supervision of NBFCs which can advance for activities banks habitually do not aid, is sanctified soon. This would guarantee the fledgling economic retrieval is not hindered by funding restraints.

Conclusion

Even though the proposal is positive for the sector, better implementation will ensure an efficient outcome. So the RBI needs to improve its supervision competencies and needs to nip in the bud the extreme interconnectedness between NBFCs and banks which is the root cause of a potentially much more hazardous virus.

***The information in this article does not necessarily reflect the views of The Global Hues. We are not responsible and do not verify for accuracy of any of the information contained in this article***

Also Read:

- CFO StraTech 2023 ME: Igniting Transformation In Financial Leadership

- From Financial Crisis To Global Cooperation: The Evolution Of G20

- Financial Planning For Business Owners: Why You Need A CFO On Your Team

- The Financial Losses The Surviving Family Of A Wrongful Death Victim Can Face

- Financial Statements Have To Follow GAAP?

- Bajaj Finserv: Offering Reliable And Trustworthy Financial Services

- Top 10 Financial Magazines In India