Discover

-

Are investment plans similar to IPL team strategies?

-

Why Research is a Must–Have Before Investing?

-

How does IPL help the Indian economy?

Are you a cricket fan who loves watching the IPL?

Do you also have a knack for smart investments?

Imagine if you could combine the excitement of cricket with investing. Intriguing, right?

You must be wondering how?

From picking the right players to making strategic decisions, the IPL has plenty of insights that can help you hit a financial six!

In the world of cricket, especially tournaments such as IPL, success isn’t about raw talent. It’s about strategy, preparation, and making informed decisions. Just like a Captain plans for cricket matches, you must invest after careful consideration of economic situations, market conditions and company fundamentals.

Imagine you’re a cricket team captain preparing for an important match. You wouldn’t just randomly pick players and hope for the best, right?

Instead, you’d study the strengths and weaknesses of your opponents, assess the pitch conditions, and analyse your team’s abilities.

Similarly, when it comes to investing, you shouldn’t just pick stocks randomly. Take the time to research the companies you’re interested in. Look at their financial health, their competitors, and the overall market conditions. Just like a captain’s strategy can determine the outcome of a match, your research can make a big difference in the success of your investments.

Let’s take a look at the different Money or Investment lessons you can learn from IPL 2024.

How can you learn more about investment from IPL?

There is a saying related to money, “It’s never too late to start.” It means that just because your salary is low, it doesn’t mean you can’t build your wealth.

8. Every Day Is Not The Same

If you watch IPL, you might have a favourite team. However, the team might perform well on some days and on some days they might perform poorly. Likewise, investment options might have performed well in the past but may not perform well today. It could be due to several reasons. But, it also doesn’t mean that it will not perform well in the future.

Example: Let’s take the fluctuating performance of Apple Inc. (AAPL). After the release of the iPhone in 2007, Apple’s stock saw significant growth. However, it faced a notable decline in 2012-2013 due to concerns about innovation and competition.

During the pandemic in 2020, the stock dropped but reached new highs as the company thrived. In 2022-2023, Apple faced volatility due to global economic challenges. This illustrates that while Apple’s stock has had both strong and weak performance, its long-term potential remains due to its innovation and strong financials. This highlights that past performance does not guarantee future results.

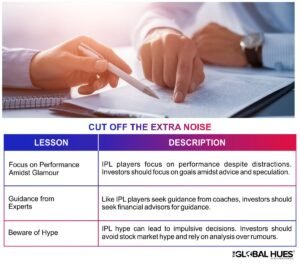

7. Cut Off The Extra Noise

IPL isn’t just about cricket, it has a lot of glamour involved as well. It is about fame, money, endorsements, media, fans, cheerleaders, etc. A new player might get overwhelmed. However, the best players keep their cool and do their job efficiently. The same is the case with investing money.

Often you become overwhelmed by all the advice, tips, and suggestions from your parents, friends, colleagues and social media. Additionally, tons of money-making advice about the next best stock to buy or sell is doled by social media influencers. Rather than taking advice from friends and family, you should get guidance from financial advisors. Consequently, they guarantee individualised investment plans and decision-making like an IPL coach.

Also Read: Tips to Save Money At An Early Age

Example: The Paytm IPO in 2021 is a prime example here. It illustrates the need for professional financial guidance. Leading up to the IPO, there was immense hype and speculation, with advice pouring in from social media, financial influencers, and peers, creating a buzz and high public interest.

Unfortunately, the stock debuted with a significant drop, resulting in immediate losses for many retail investors who were swept up in the excitement without fully understanding the risks. This situation highlights the value of professional advice in making informed investment decisions.

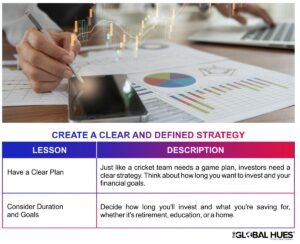

6. Create A Clear And Defined Strategy

Any cricket team wouldn’t enter a match without a game plan, investors should approach the market with a clear and defined strategy. You must also factor in the duration you intend to hold your investments. It helps with determining the suitable asset allocation. Moreover, you should outline your financial goals- whether it is retirement planning, funding a child’s education, or saving for a home down payment. These goals serve as a pathway for your investment choices.

Example: Reliance Industries is the best example to understand this point. It has consistently pursued a strategy of diversification and innovation, aiming to become a global leader in multiple sectors. Mukesh Ambani’s strategic vision includes investments in digital technology (Jio Platforms), retail (Reliance Retail), energy (Reliance Petroleum), and more. Consequently, the strategy aligns with Reliance Industries’ goal of becoming a conglomerate with a diversified revenue stream.

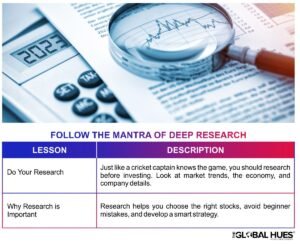

5. Follow the mantra of Deep Research

Even in cricket, a captain wouldn’t send a batsman onto the pitch without knowing its nuances. Likewise, you shouldn’t enter the market without conducting proper research. Investing requires careful consideration of market trends, economic situations, and company fundamentals.

Why Research is a Must–Have Before Investing:

- It helps you make informed decisions about which stocks to invest in

- Research helps you avoid common beginner mistakes

- Through Research you can develop a solid investment strategy

- Once you do thorough research, you can spot warning signs in stocks

Example: Let’s understand this point with the example of Rakesh Jhunjhunwala. He is often referred to as the “Warren Buffett of India.” His success in the stock market is attributed to his rigorous research and analysis of company fundamentals, market trends, and economic conditions before making investment decisions.

Consequently, his early investment in Titan Company Limited, based on a thorough understanding of the company’s business model and growth potential, resulted in substantial long-term gains.

4. Start Investing Early & Continuously

In a cricket match, especially in the IPL in which there are only 20 overs, the batsmen aim to make an unbeatable score. Moreover, in the IPL, the powerplay overs are crucial for this purpose. Just as each run can earn additional runs in cricket, the same way early investment allows your money more time to ‘compound.’

Investing early helps but what helps more is investing continuously. In a match steady hitting helps, and consistent investing builds money over time, especially with methodical investment planning.

Example: Let’s take HDFC Bank’s success story here. It illustrates the benefits of early and continuous investment. Since its inception in 1994, the bank invested heavily in technology, infrastructure, and talent. It embraced digital innovations early on and continuously expanded its branch network and product offerings.

3. Diversify Your Portfolio

As a team, you cannot depend on one or two good batsmen or bowlers to win the match. A team needs a balance of batsmen, bowlers, and all-rounders for continuous success. Similarly, your portfolio should be a mix of all asset classes like equity, debt, gold, real estate and more. If your portfolio concentrates on a single asset class, it may suffer at certain times.

Example: Let’s take the example of Tata Group here. It has diversified its investment across various sectors including automotive (Tata Motors), information technology (Tata Consultancy Services), steel (Tata Steel), consumer products (Tata Consumer Products), and more. Moreover, the diversification strategy ensures that the group’s overall portfolio remains stable and less vulnerable to sector-specific risks.

2. Review Your Investment Regularly

The IPL games are played for 20 overs. However, the tournament is for about 2 months. It is a long period and players performance can fluctuate. Additionally, team strategies like batting order or impact substitutes also need constant fine-tuning. Likewise, you should regularly review the performance of your investments and make changes accordingly. You should review your investments on a short and long-term basis.

Example: Infosys is one of India’s leading IT services companies. It continuously reviews and adjusts its investment in emerging technologies such as artificial intelligence, cloud computing, and cybersecurity, to stay competitive in the rapidly evolving tech industry.

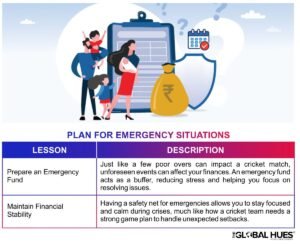

1. Plan For Emergency Situations

Sometimes in cricket matches, a few poor overs or the team losing wickets quickly can result in losing the match. Likewise, unforeseen events can impact your financial stability. An emergency fund serves as a buffer. When you have a safety net for emergencies, it not only reduces stress but also enables you to concentrate on resolving the situation at hand.

Example: The best example of this is how companies reacted to the pandemic. Companies that had robust contingency plans and maintained cash reserves were better equipped to weather the economic downturn caused by the pandemic. Likewise, having an emergency fund in place allowed companies to mitigate financial stress and focus on implementing strategies to overcome the unprecedented crisis.

The Bottom Line

Cricket and Investment lessons might seen as a weird combination. But you can learn a lot from this tournament. So, here are the eight investment lessons you can learn from IPL.

Also Read: IPL 2024: Advertisers Hitting A Six In Every Ball. How?

Frequently Asked Questions

How does IPL help the Indian economy?

The IPL’s most significant contribution to the Indian economy is its boost to tourism and hospitality. According to the International Cricket Council (ICC), India constitutes 90% of the global cricket fanbase which shows the demand and liking people have for the IPL.

How to get IPL tickets in 2024?

You can buy IPL tickets online on the official IPL website, as well as through the Paytm App, Paytm Insider App, and Insider. in.

Where is the IPL 2024 final?

IPL 2024’s final is in Chennai on May 26.

Who is at the top in IPL 2024?

| Rank | Team |

| 1 | Kolkata Knight Riders (Qualified) |

| 2 | Rajasthan Royals (Qualified) |

| 3 | Chennai Super Kings |

| 4 | Sunrisers Hyderabad |

How much does RCB earn from IPL?

Royal Challengers Bangalore (RCB) has earned 738 crore from IPL.