Discover

-

The consequences of not filing an Income Tax Return

-

Penalties for missing the deadline to file an ITR

-

What benefits are lost if you fail to file your ITR on time?

What happens if you don’t file an ITR (Income Tax Return)?

While the mountain won’t collapse if you don’t file an ITR, there are some serious consequences of it.

And we are not only talking about fines here. We are talking about the additional benefits that you lose if you don’t get into the habit of filing an ITR every year.

So, is it mandatory to file an ITR? We would say- Yes!

31st July 2024 is the last date to file ITR for FY 2023-24 (AY 2024-25). If you miss this deadline and file your return later, you will have to pay a penalty under Section 234F and interest under Section 234A.

Any individual who generates a taxable income must file an income tax return on time as it helps the government maintain records of taxpayers. Any failure to file an ITR results in penalties and problems later on as it can become a case of tax evasion as well. Additionally, it also hampers the chances of getting a loan, property registration, or a visa for travel purposes.

Who Should File ITR?

As per the Income Tax Act, the below-mentioned entities must file the ITR in India:

- All individuals (below the age of 60) whose gross total income exceeds Rs. 2.5 lakhs need to file the taxes. Senior citizens (60-79 years) earning above Rs. 3 lakhs, and super senior citizens (80 years and above) with incomes surpassing Rs. 5 lakhs should file ITR.

- Firms or companies must file their ITR irrespective of their returns

- Resident individuals who possess asset or financial interest in an entity located outside India

- International firms or companies doing business in India

- Individuals who want to demand an income tax refund or carry forward a loss under a head of income

- Non-resident Indians who have made over Rs. 2.5 lakhs in India

- Residents & signifying authorities in a foreign account

- Individuals who earn income from assets or property- coming under research associations, news agencies, political parties, educational institutions, hospitals, infrastructure debt funds, or any authority or trust.

Also Read: What Are The Documents You Need To File An ITR?

What Happens If You Don’t File Your ITR?

If you don’t file an ITR within the due date then the taxpayer has to bear the following consequences:

-

Penalty or Late Fees

Non-filing of ITR results in a penalty. If you earn above Rs. 5 lakh and file your returns after the due date, then you will have to pay a penalty of Rs. 5,000. However, if the taxable income is below Rs. 5,00,000, the penalty amount is Rs. 1,000.

-

Loss of Specific Benefits

Due to the non-filing of the returns within the prescribed deadline, you would not be allowed to claim the benefits of certain deductions and carry forward the losses other than the loss from house property loss.

-

Interest on the Tax Amount

In case of failure to pay the ITR on time, the taxpayer pays an interest of 1 per cent per month until the ITR is filed. Moreover, the stated interest is payable on the tax payable after decreasing the tax deducted at source, tax collected at source, and other tax credits available.

-

A case of Tax Evasion

Non-filing of ITR may also reflect in the minds of income authorities that the motive was tax evasion. Such defaulting taxpayers can face prosecution under Section 276CC of the Income Tax Act. Furthermore, it may result in harsh imprisonment for a term ranging from a minimum of 3 months to 2 years along with a fine, depending on the amount of tax evaded.

-

Reduced Time for Updating ITR

If a taxpayer commits a mistake while filing the returns, there are certain rules to be followed to make the required changes. Earlier, taxpayers had a 2-year window to resubmit ITRs, now the window has been reduced to one year by the government. Therefore, the sooner you file the returns, the longer the window to review & revise returns and rectify the errors if any.

If you are filing the ITR for the first time, know how to file it

THERE ARE EXEMPTIONS TOO!

Under Section 119 (2) (b) of the Income Tax Act 1961, the authority body can consider any application or request for an exemption, deduction, or other relief even after the ITR filing date has expired. If the reason behind the non-filing of the ITR stands valid in the eyes of the concerned authorities, the taxpayer may apply for condonation relief by presenting appropriate supporting documents as evidence.

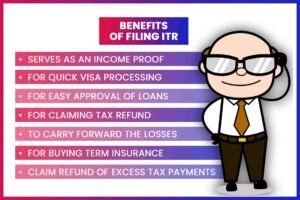

BENEFITS OF FILING AN ITR

Now, let’s talk about the benefits too.

-

Serves As An Income Proof

For salaried employees, ‘Form 16’ issued by the employer acts as income proof. However, for self-employed taxpayers, an income tax return serves as authentic income proof with a detailed breakdown of income and expenses during a financial year.

-

For Quick Visa Processing

The immigration authorities request copies of tax returns filed in the past when individuals apply for a Visa to take up a job or conduct business visits outside the country. Filing Income Tax returns ensures smooth and quick processing of VISA applications as the immigration authorities consider the individual as tax compliant. Certain embassies of countries like Canada, the US, the UK etc are very particular about the tax return records of an individual.

-

For Easy Approval of Loans

While applying for a home loan, ITR is one of the most crucial documents that a lender asks to process the home loan application. If the individual is unable to provide such a document, it will result in the non-acceptance of the application.

-

For Claiming Tax Refund

Sometimes TDS gets deducted from the salary even when the total taxable income is less than the basic exemption limit and the taxpayer has a nil tax liability for that year. In such cases, the taxpayer claims the TDS refund for which filing an ITR is compulsory.

-

To Carry Forward The Losses

A taxpayer can carry forward the losses only if he/she files the ITR before the deadline. If not paid on time, he/she can’t carry forward any loss under the head of ‘profits and gains of business’ or capital gains. Though there are alternatives in case you miss filing ITR due to several reasons, you should file returns on time to avoid unwelcoming repercussions.

-

For Buying Term Insurance

If you are planning to buy a term insurance, insurance providers often require applicants to submit their Income Tax Return (ITR) records as proof of their annual income and to approve the term insurance plan. Moreover, the term plan’s coverage is determined based on the individual’s earnings and providing the ITR helps insurance providers assess a person’s higher income level.

-

Claim Refund of Excess Tax Payments

There are chances that even if your income is below the taxable threshold, taxes will be deducted from your salary, fixed deposit (FD), or other income. For instance, even if your income is less than Rs 2.5 lakh, but you receive Rs 1 lakh from an FD, the bank will deduct 10% tax on this amount. In such a situation, individuals can claim a refund for the tax deducted by filing an Income Tax Return (ITR).

FREQUENTLY ASKED QUESTIONS:

Who is not required to file an Income Tax Return?

Individual taxpayers who are below the basic exemption limit don’t have to file income tax returns. Nil return is filed when income falls below the taxable limit.

What happens if you forget to declare your income?

If you miss the deadline for filing your ITR, you can still file a belated return by a specified date. Furthermore, you need to pay a penalty for late filing.

Can I skip ITR for a year?

If you miss the returns filing deadline, you may face penalties, interest charges, and loss of benefits.

Does a housewife need to file an ITR?

A housewife needs to file an ITR if her total annual income from sources like interest, investments, etc, exceeds the basic exemption limit of Rs. 2.5 lakh (below 60 years) for the old regime and Rs. 3 lakh for the new regime.

Can an unemployed person file an ITR?

Yes, you can file an NIL return in a process similar to when you file an income tax return.

Who pays the highest tax in India?

Companies like RIL, SBI, and HDFC Bank are the top taxpayer companies.

How much FD interest is tax-free?

Banks or post offices deduct tax or TDS when the aggregate interest income on all fixed deposits exceeds Rs 40,000 per financial year. Additionally, the limit is 50,000 in the case of a senior citizen.