Due to ongoing, substantial supervisory concerns and persistent non-compliance, the Reserve Bank of India (RBI) has taken action against Paytm Payments Bank. Paytm Payments Bank Ltd (PPBL) is an associate of the listed business One 97 Communications. This is how the customers would be affected.

How RBI’s ban on Paytm impact you and your finances from 1 March?

Starting from February 29 2024, Paytm Payments Bank won’t be able to accept new users. If you aren’t using Paytm, you can’t create a new account after this date. Existing users won’t be able to use Paytm wallets, Fastags, or Mobility Cards after February 29. It has happened because RBI has barred the listed fintech’s payment bank from offering banking services after February. The action has been taken against One 97 Communications because of “non-compliance and continued material supervisory concerns in the bank,” RBI said.

With over 100 million KYC customers, Paytm Payments Bank Ltd (PPBL) is an associate company of Paytm. Moreover, it has 30 million bank account holders, 300 million wallet users and 17% value-based market share in FASTag. Although the regulator had already prohibited PPBL from accepting new customers, the most recent measures forbid Paytm from processing any credit or deposit transactions after February 29, 2024.

Can I still use Paytm UPI?

As a customer, you should stop using the bank account as of February 29. However, if you use the Paytm for UPI and wallet payments—where the underlying bank account may be with a different bank—you should be able to continue as usual. Customers can use Paytm as a digital payment option as long as their bank account is linked to an external bank, as the RBI action targets the company’s banking operations.

What will happen if your Paytm app is linked to your bank account with the payments bank?

Customers can transfer money between accounts or wallets without any limitations. Account holders can move funds between their bank accounts and wallets, but as of March 1st, they wouldn’t receive money.

What to do if you use Paytm Fastag or its National Common Mobility Card?

The RBI has permitted consumers to deactivate their accounts. However, as of March 1, 2024, they cannot add funds to these instruments.

Where does the RBI ban stem from?

” The RBI’s recent imposition of major business restrictions on Paytm Payments Bank stems from persistent non-compliance and supervisory concerns uncovered in comprehensive audits. This regulatory action underscores the imperative for financial institutions to adhere to compliance standards, safeguard consumer interests, and maintain the integrity of the banking system. By restricting new customer onboarding and transactions, the RBI aims to address identified issues and uphold the credibility of the banking sector,” said Rajesh Rai, Managing Partner, RR Legal Partners LLP.

The consequences would affect customer confidence, raise questions about Paytm’s reputation, and increase the scrutiny of regulatory compliance. This development emphasises how crucial it is for the financial industry to have strong governance and adhere to regulations.

Why did RBI impose major business restrictions on Paytm Payments Bank?

The apex bank has responded to a thorough system audit report and a follow-up compliance validation report from outside auditors by taking this step against Paytm. Concerned about non-compliance, the RBI had already ordered the bank to designate an Income Tax audit firm. This action ensured a comprehensive System Audit of its IT system in 2022. This step complies with the RBI’s March 2022 mandate, which directed PPBL to cease onboarding new clients.

How will RBI’s action against Paytm Payments Bank impact customers?

There will be no additional deposits, credit transactions, or top-ups in customer accounts, prepaid cards, wallets, FASTags, or National Common Mobility Cards after February 29, 2024. After the designated date, customers will not be permitted to deposit anything. However, users may still withdraw funds from their accounts.

Counter Measures

Paytm Payments Bank ban: How will founder Vijay Sharma save the Paytm app from the ban by RBI and continue to work as usual?

On Thursday, RBI announced that it is no longer permitted to accept top-ups or deposits into the Paytm Payments Bank or any associated services. In his attempt to reassure customers that the app will continue functioning normally, founder Vijay Shekhar Sharma took to his X (formerly Twitter) account one day after the RBI said that Paytm Payments bank would no longer be allowed.

Sharma thanked all Paytm users in a post addressed to them all, saying that he and the other members of Paytm appreciated their support. Furthermore, the app is operational and will continue functioning normally after February 29.

Regarding the RBI prohibition, Sharma stated that Paytm ensures serving the country in full compliance and that there is a solution for every problem. In closing, Sharma states that “PaytmKaro is the biggest champion of it” and that “India will continue to win global accolades in payment innovation and inclusion in financial services.”

Paytm Payments Bank ban by RBI: What happens to your money? What are the alternatives for you?

The RBI has prohibited Paytm Payments Bank from taking new customers and collecting deposits. What you should know about other possibilities and money withdrawals is provided here. According to Section 35A of the Banking Regulation Act, 1949, RBI has announced that it will no longer accept deposits or top-ups for the Paytm Payments Bank and related services.

It is due to “persistent non-compliance and continued material supervisory concerns in the bank.” This move will have an impact on millions of users.

How to transfer money from Paytm Payments Bank to other bank accounts?

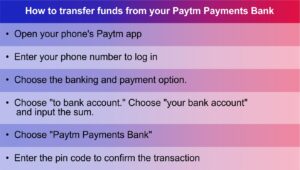

Use these guidelines to transfer funds from your Paytm Payments Bank:

1. Open your phone’s Paytm app.

2. Enter your phone number to log in.

3. Choose the banking and payment option.

4. Choose “to bank account.” Choose “your bank account” and input the sum.

5. Choose “Paytm Payments Bank”.

6. Enter the PIN code to confirm the transaction.