On 1 Feb, 2024, the Finance Minister, Smt. Nirmala Sitharaman presented the Union Budget 2024 in Parliament. The budget outlines key projections and initiatives for the upcoming fiscal year. This year’s budget emphasises infrastructure development, fiscal consolidation, and welfare measures that target various sections of Indian society. The budget aims to make India a developed nation by 2047.

The article focuses on the budget summary, essential points of the budget, and how will the salaried employees and middle class benefit from this budget.

Summary of Union Budget 2024

This year’s budget focuses on welfare programs that aim at different societal groups, budgetary consolidation, and infrastructure development. The budget assumed India’s nominal GDP growth of 10.5 per cent for 2024-25, demonstrating the country’s tenacity in the face of severe global economic difficulties. From 2014 to 2023, foreign direct investment (FDI) inflows totalled USD 596 billion, a substantial rise over the preceding ten years. With an emphasis on inclusive development, the budget reaffirms the government’s commitment to uplifting the underprivileged, women, youth, and farmers.

To empower the young and encourage innovation, a fifty-year interest-free loan of Rs. one lakh crore would be used to construct a corpus. The total spending of Rs 1.3 lakh crore will help maintain programs such as the 50-year interest-free credit for capital expenditure to states.

Under the UDAN system, initiatives include expanded airport development, port connection, and railway corridor activities. There are plans to leave the tax benefits for entrepreneurs and investments from sovereign wealth funds unchanged. Up to a specific amount, unpaid direct tax requests can be withdrawn, which would help about one crore taxpayers.

10 Key Points from Budget 2024?

- GDP Growth: Projected at a nominal GDP growth of 10.5 per cent for 2024-25, reflecting resilience.

- Capital Expenditure: Increased by 11.1 per cent to Rs 11,11,111 crore, aimed at stimulating growth and employment.

- Fiscal Deficit: Estimated at 5.1 per cent of GDP, adhering to fiscal consolidation targets.

- FDI Inflow: Reaching USD 596 billion during 2014-23, showcasing a significant growth phase.

- Priority Sectors: Focus on uplifting the poor people, women, youth, and farmers to ensure inclusive development.

- Interest-Free Loans: Establishment of a Rs. 1 lakh crore corpus for youth empowerment through interest-free loans.

- Continuation of Schemes: Initiatives like the 50-year interest-free loan for states with a total outlay of Rs 1.3 lakh crore.

- Infrastructure Development: Emphasis on railway, port, and airport development to enhance logistics and connectivity.

- Taxation: Continuity in tax rates with extended benefits for startups and sovereign wealth investments.

- Direct Tax Reforms: The government will withdraw outstanding direct tax demands to ease taxpayer burden.

How Union Budget 2024 will help the middle class?

Several initiatives are introduced in the Budget 2024 to improve the middle class’s prospects and financial situation in India. Acknowledging the middle class’s crucial role in the country’s socioeconomic structure, the government has unveiled programs intended to offer concrete advantages and assistance to this social group. A new program will support middle-class people in purchasing or developing their own houses, increasing the number of homeowners. Higher tax rebate limits are part of the budget, which lessens the tax burden on people making up to Rs 7 lakhs in income.

The government will remove unpaid tax demands up to a specific amount. It would provide around one crore taxpayers with some relief. Increased investment in construction and infrastructure would boost employment and economic growth, which will help the middle class. GST process simplification eases trade and industry compliance burden and may result in lower consumer costs for products and services.

What are the top 5 benefits for salaried employees from budget 2024?

Here are the top five benefits for salaried employees outlined in Budget 2024:

-

Higher Tax Rebate Limits

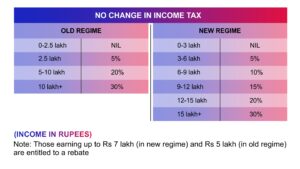

Salary earners earning up to Rs 7 lakhs would benefit from the budget’s introduction of higher tax rebate limits. By lowering their tax burden, middle-class people would keep a sizeable portion of their hard-earned money.

-

Simplified Tax Slabs

For many wage workers, the new tax slabs lower their tax bill and simplify tax computations. The budget seeks to simplify the tax system and make it more equal and simple for paid workers to pay taxes.

-

Withdrawal Of Outstanding Direct Tax Demands

The budget proposes the withdrawal of outstanding direct tax demands up to certain limits. This initiative eases the financial burden and anxiety for salary employees as they would get relief from unresolved tax issues.

-

Increased Infrastructure Spending

The government’s emphasis on spending more on infrastructure improves overall economic stability and generates job opportunities. Therefore, the generation of new jobs and the promotion of economic growth indirectly help salaried workers.

-

Simplified GST Processes

Lowering the compliance burden for businesses through simplifying GST procedures may result in cheaper goods and services. Salary workers gain from this lower cost of living because it increases their purchasing power and general financial security.

Summing Up

The Union Budget 2024 presents a comprehensive strategy prioritising infrastructure development, fiscal consolidation, and welfare initiatives to benefit various segments of Indian society. The budget strives for inclusive growth, increased capital investment, and steps towards fiscal control.

Interest-free loans for youth empowerment, ongoing programs, and infrastructural improvements are essential measures. The budget provides advantages such as streamlined tax slabs and increased tax rebates for the middle class. Tax changes and increased infrastructure spending will benefit salaried workers and promote economic stability.