In early 2022, India proposed National Medical Devices Policy 2022 to facilitate orderly growth of the medical devices sector in the years to come by putting in place a comprehensive set of measures for the sector. The policy addresses concerns over accessibility, affordability, safety and quality, and focuses on self-sustainability and innovation. Against this backdrop, the Indian Medical Devices market has the potential to increase at a 37% CAGR and reach $50 bn by 2025.

The Indian government has identified medical devices as a priority sector in the ‘Make in India’ program. Another scheme, The Production Linked Incentive Scheme (PLI) launched by the government promotes domestic manufacturing of medical devices. Production linked Incentive Scheme for pharmaceuticals has also been introduced to push India’s vision of becoming a global manufacturing hub for medical devices.

SOME FACTS

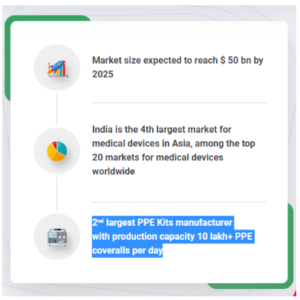

- Among the top 20 markets for medical devices globally, India is the 4th largest market for medical devices in Asia after Japan, China and South Korea,

- The market size of the medical device industry is expected to reach $ 50 bn by 2025

- There are more than 6,000 types of medical devices in India

- It is the 2nd largest PPE Kits manufacturer with a production capacity of 10 lakh+ PPE kits per day

- There are a total of six manufacturing clusters for Medical Devices: Gujarat, Haryana, Maharashtra, Andhra Pradesh, Karnataka, and Tamil Nadu.

SEGMENTS OF THE MEDICAL DEVICES SECTOR

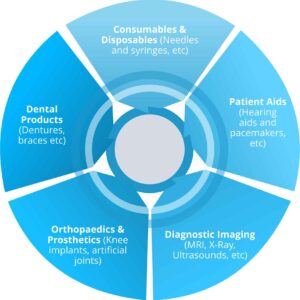

The entire medical devices industry can be segregated into five major segments. They are:

- Consumables & Disposables (Needles and syringes, etc)

- Patient Aids (Hearing aids and pacemakers, etc)

- Diagnostic Imaging (MRI, X-Ray, Ultrasounds, etc)

- Orthopaedics & Prosthetics (Knee implants, artificial joints)

- Dental Products (Dentures, braces etc)

INITIATIVES BY THE GOVERNMENT

- The government allocated Rs. 86,200 crores in the Union Budget 2022-2023 for the pharmaceutical and healthcare sector

- The department of pharmaceuticals launched a PLI scheme to foster domestic manufacturing of medical devices, with a total outlay of funds worth Rs. 3420 crores for FY21-FY28.

- In November 2021, the Indian Council of Medical Research (ICMR) collaborated with the Indian Institutes of Technology (IIT) to set the foundation of ‘ICMR at IITs’ by setting up Centres of Excellence (CoE) for Make-in-India product development and commercialisation in the medical devices and diagnostics space.

- The Medical devices sector has been recognised as a ‘Sunrise Sector’ by the government of India under the ‘Make in India’ campaign in 2014

- To build a medical device park in the township of Himachal Pradesh, Nalagarh in Solan District, the government-sanctioned a proposal worth Rs. 5,000 crore

GROWTH DRIVERS

-

Introduction Of Medical Parks

Recognising the need for a higher level of investments for the creation of proper infrastructure in the medical devices sector, the Department of pharmaceuticals launched a scheme for the Promotion of Medical Device Parks. Proper infrastructure will create a robust ecosystem for medical device manufacturing in the country. The other objectives are:

- Easy access to standard testing and infrastructure facilities by creating top-notch infrastructure facilities will reduce the production cost of medical devices which would eventually lead to better affordability and availability of medical devices.

- Reaping the benefits that would arise due to optimization of resources and economies of scale.

-

Rise In Medical Tourism

Due to the low cost of medical care in India, medical tourism is experiencing a 22-25% growth. Reasonable cost of accommodation, entertainment facilities, favourable healthcare infrastructure, positive service quality of healthcare personnel, transportation and medical fees are other factors contributing to the rise of medical tourism. Medical tourism contributes over $2 billion to the Indian healthcare sector. The rise in medical tourism leads to rising demand for healthcare and medical devices.

-

Health Insurance

Approximately 20 per cent of the Indians have health insurance cover and this number is expected to increase with rising incomes and growing urbanisation. Health insurance leads to an increase in demand for healthcare services and thus, medical devices.

-

A rise in Disposable Income

To request a service, one must ask for it and should be able to afford it. Demand for medical care increases when there is an increase in disposable income. According to the statistics, 8% of Indians will earn more than $12,000 per annum by 2026.

-

Changing Preferences

Growing awareness for health, changing attitudes towards preventive healthcare, & the onset of different kinds of deadly diseases are also leading to the growth of the Indian medical devices industry. It is quite clear that the Indian Medical Devices Industry is on the verge of gaining tremendous heights.

RECENT INDUSTRY TRENDS

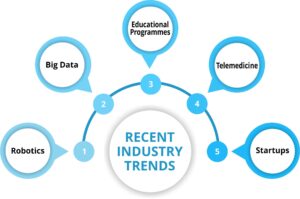

The Indian Medical Device Industry has witnessed tremendous growth over the last decade. The current trends indicate even higher growth potential. Here are some trends that would provide an impetus to the medical device industry:

-

Robotics

Robotics is emerging as the fastest-growing field in healthcare. In medical manufacturing, robots are used in the entire production line –from assembly to inspection and packaging. The surgical robotics segment holds enormous potential. Manufacturers are increasing their Research & Development (R&D) efforts within robotic surgical systems.

-

Big Data

The medical devices industry generates an abundance of data which can have a significant clinical impact. However, the data captured from medical devices remain wasted and underutilised. Thankfully, the rise in predictive analytics is changing the technological lag. It is a technology that learns from experience (data) to predict future trends with an aim to drive better decisions.

Predictive analytics models are using ‘Big Data’ to improve the quality of care and patient outcomes. Various companies are utilising this technology by gathering key patient vital signs along with other observations from devices in order to make informed decisions about the patients’ health.

-

Educational Programmes

As the world demands trained professionals in the medical field, numerous educational institutions have been introduced to provide training and research in the medical devices field. The government has also undertaken some key initiatives like setting up medical colleges, funding the expansion of existing colleges, and increasing the capacity of medical students.

-

Telemedicine

As per the reports, the Indian Telemedicine market in India is expected to reach USD 5.5 bn by 2025. Trials conducted in this field have demonstrated that remote consultations cost about 30% less than equivalent in-person visits, replacing half of the in-person consultations in India. Telemedicine Guidelines of India, 2020 launched by the Government of India promises to pave a road map for the regularisation and diversification of teleconsultation services across the country.

-

Startups

Many Indian startups and SMEs are entering the medical devices industry and contributing their significant part. There are more than 250 active MedTech Startups based out of India. Health-tech and Digital Health startups in India have raised over the US $2 billion between 2011-2020 with 500+ investments into 340+ companies.

Source: The information in this report has been obtained from the India Brand Equity Foundation, a Trust established by the Department of Commerce, Ministry of Commerce and Industry, Government of India and Invest India, National Investment Promotion & Facilitation Agency of India, a non-profit venture under the aegis of Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry, Government of India.

Must Read:

- SUCCESS STORY OF TIM COOK: A MAN WITH A VISION

- TOP 10 RICHEST BILLIONAIRES IN THE WORLD 2022

- Top 10 Indian Origin CEOs Leading International Companies

- HIGHEST-PAID CEOs IN THE WORLD

- Success Story Of Mukesh Ambani

- TOP 10 NEWSPAPERS IN THE WORLD 2022

- Elon Musk: Biography Of A Self-Made Entrepreneur And Billionaire

- 10 GADGETS TO KEEP YOU COOL THIS SUMMER

- 7 R’s Of Waste Management – Steps To Sustainability

- What Are The 5 Must Watch Netflix Thrillers

- Upcoming Shows And Films On Netflix In 2022