Highlights:

- The six listed firms of the Adani Group had a gross debt of ₹2,30,900 crore as of FY22-end. Net debt after accounting for cash in hand was approximately ₹1,72,900 crore.

- “In the worst-case scenario, overly ambitious debt-funded growth plans could eventually spiral into a massive debt trap, and possibly culminate into a distressed situation or default of one or more group companies,” said CreditSights, a Global Credit Market Research platform.

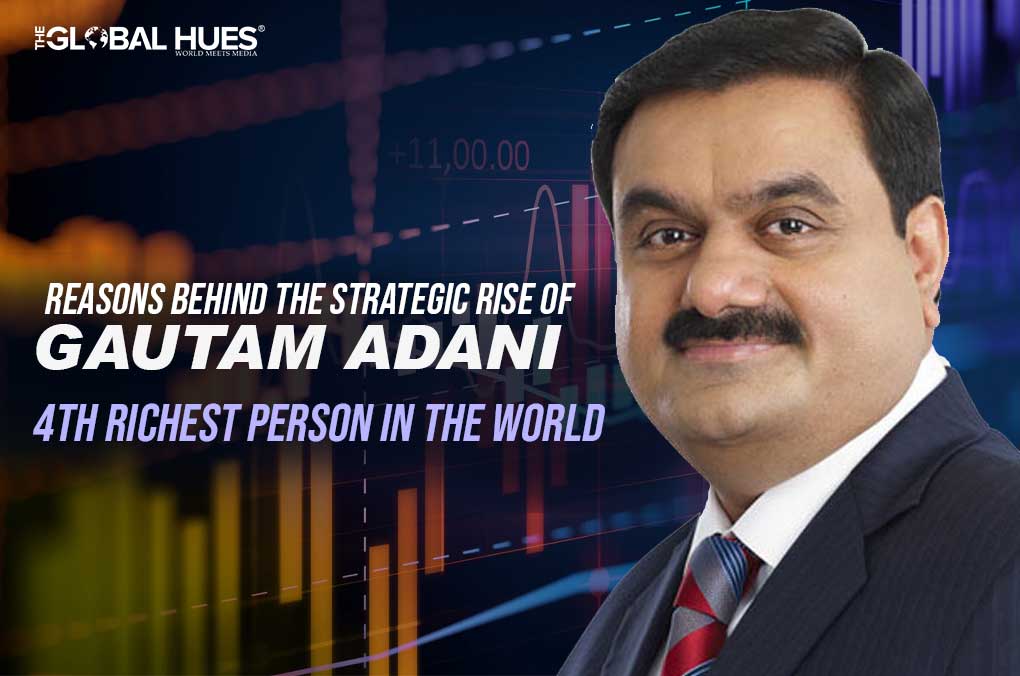

An Indian business tycoon and the Chairman of Adani’s Group, Gautam Adani is once again making the headlines for all the right reasons. Gautam Adani has become the fourth richest person in the world with a net worth of 132.9 Billion (as of October 2022).

He is behind Elon Musk, Bernard Arnault, and Jeff Bezos on the list with a net worth of $219.8 Billion, $147.4 Billion, and $138 Billion respectively (as of October 2022).

But what has led to the meteoric rise of Gautam Adani? Before delving deeper into the reason, let’s first understand his status as a billionaire in the world’s largest continent.

First Asian To Become 3rd Richest Billionaire

It happened for the first time ever in history that an Asian made it to the top 3 billionaires in the list of Bloomberg Billionaire Index in September 2022. 60 years old Gautam Adani achieved a milestone that other rich Asians such as Jack Ma and Mukesh Ambani couldn’t. Adani reached a new high after becoming the third richest person in the world.

Besides Adani, other Asians that make their way to the list of top 20 Billionaires in the world are Mukesh Ambani and Zhong Shanshan. Mukesh Ambani is standing at 11th position with a total net worth of $91.9 billion. While Zhong Shanshan is at the 13th position with a net worth of $70.8 Billion.

Reason Behind Dynamic Rise Of Adani

Business conglomerates Adani Group’s Co-Founder and Chairman, Gautam Adani has over the years positioned himself among one of the largest business leaders in Asia. Quite obviously!

The companies in Adani Group include Adani Enterprises, Adani Transmission, Adani Wilmar, Adani Green Energy, Adani Total Gas, Adani Power and Special Economic Zone.

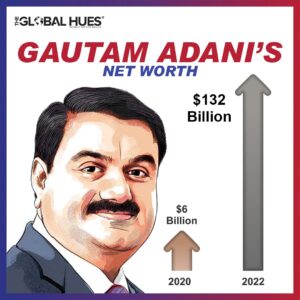

The revenue generated by the Adani group is enormous. According to the reports, Adani’s net worth has increased approximately 23 times.

However, many experts raise concerns over the rapid expansion and growth of Adani’s wealth. CreditSights in its reports mentioned that the Port-to-Power conglomerate of Adani is “deeply leveraged”. CreditSights also claims that the Adani Group is investing heavily in existing and emerging businesses by predominantly using debts.

Also Read: Adani-Hindenburg Conflict: An Attempt To Defame Or A Con?

“In the worst-case scenario, overly ambitious debt-funded growth plans could eventually spiral into a massive debt trap, and possibly culminate into a distressed situation or default of one or more group companies,” said CreditSights in its report.

Under the flagship company, Adani Group has invested decisively in various sectors including airports, data centres, green hydrogen, petrochemical, cement, copper refining and solar manufacturing in the past few years.

Must Read: Success Story of Gautam Adani

Companies of Adani groups are publicly listed on the Bombay Stock Exchange. And investing in the shares of these companies is said to be highly profitable. Adani’s share is among the top shares that give the highest profit returns. Many lawmakers and share market experts raise concern over the shareholder structure and its opaqueness. Yet, Adani’s share prices are escalating rapidly.

Adani is said to be on great terms with the Indian Prime Minister Shri Narender Modi and working diligently to meet India’s long-term goals.

The Great Acquisitions By Gautam Adani

Adani is expanding its business empire by acquiring businesses in different verticals. Some of the biggest acquisitions by Adani Groups include:

- In August 2022, Adani Group indirectly acquired 29.18% of the total shares in NDTV, using its financial rights of conversing loans into an equity stake.

- On April 22, 2022, Adani ports and Special Economic Zone (APSEZ) acquired a 100% stake in India’s largest marine service company Ocean Sparkle for Rs 1700 crores.

- Last year (2021) Adani Ports and Special Economic Zone (APSEZ) acquired key stakes in Gangavaram Port.

- Adani groups acquired Ambuja Cements and ACC after raising funds of $5.25 Billion from global banks in 2022.

What Next Now?

Gautam Adani has recently announced investment of Rs 65,000 crores in Rajasthan in next 5 to 7 years. Will this investment add up to the reasons for the strategic rise of Gautam Adani?

Will this investment unlock Adani’s way of becoming the world’s richest person?